Recession or Relief?

When a whipsaw happens, it is best to stop it if possible, and avoid it at all cost. It’s human nature to respond to sudden [inorganic] demand and create too much supply. When the sudden demand vanishes, a supply glut results. Prices and stress levels go up and down and back up. The only real constant is that this market is not “freely allowing participants to exchange value”. That’s what FREE markets do. We are too busy fighting about Wuhan, Ukraine, and Biden’s cognitive disorders to see how the government created the sudden demand, the supply shrinkage, and now applying their whipsaw to the mess they threw at us. But, like a pressure cooker, relief is a good thing. And we’re going to experience some relief.

To make it worse, again with the human nature, sellers want to partake in the seemingly “top of the market” – before the relief valve is fully opened. Sellers are currently finding they don’t have as many buyers as their neighbor had just last month. Open houses and patience are now more popular. Price reductions, if a seller is serious, are frequent. And buyers can now offer less than asking price AND re-negotiate based on serious issues on the inspection reports. But buyers who were close to priced-out last month have exceeded their budgets with the cost of a loan.

All in all, the times they are a-changin’. And the forces driving the change are not coming from wise people.

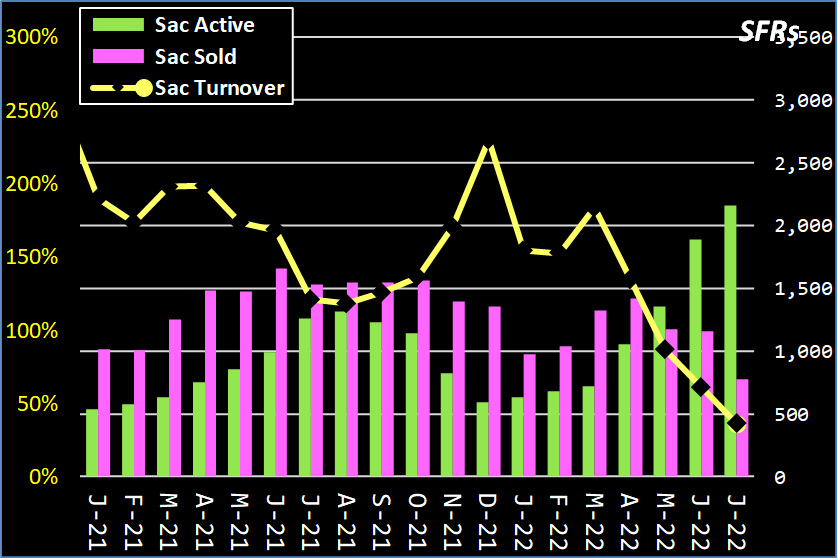

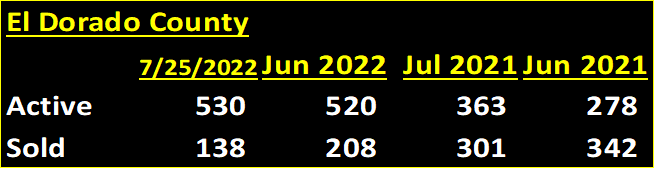

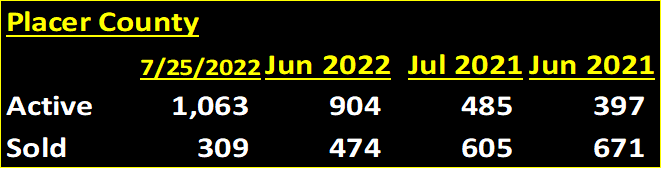

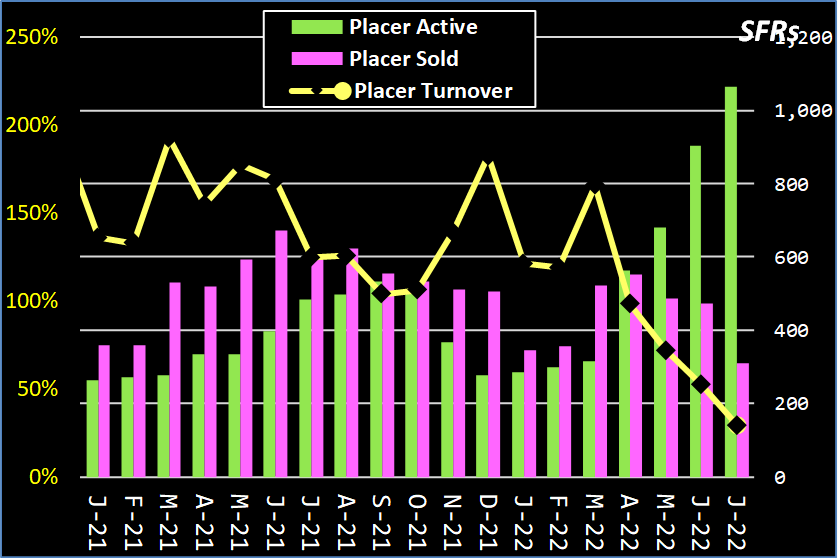

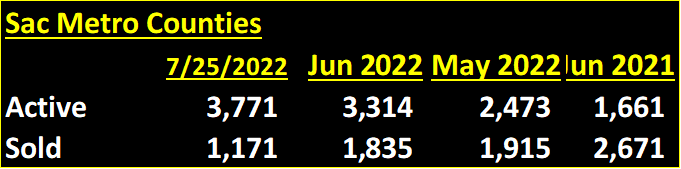

As of 07/25/22, where Turnover equals Sold/Active, preliminary data shows the drop in demand and increase in supply. As a listing agent, my sellers know this information and still desire to sell. They, too, have an expectation that values won’t drop fast. But prices are coming down and buyers are few. The “Relief” has commenced, in my humble opinion.

Market Menu

Overview – Major – Financing – Averages – Momentum – Counties

Zip Codes Charted

Fair Oaks – Folsom – Roseville – Orangevale – El Dorado Hills – Carmichael – Citrus Heights – Elk Grove – Placerville – Auburn – Lincoln – Rocklin – Rancho Cordova