Sacramento Metro Real Estate Market

Buyer Financing

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

Intro

How buyers buy houses helps us understand the reasons for demand. When escrow closes, a seller gets cash. So it’s the burden / nuisance of the borrower’s financing DURING escrow that matters to sellers.

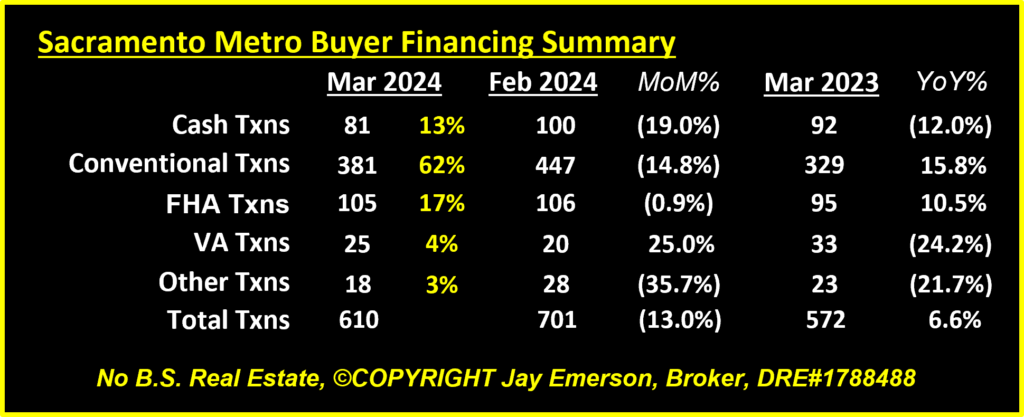

Summary

This graphic is a snapshot of each type of financing used for the closed transactions in MLS. Shifts in money sources help explain other relevant changes.

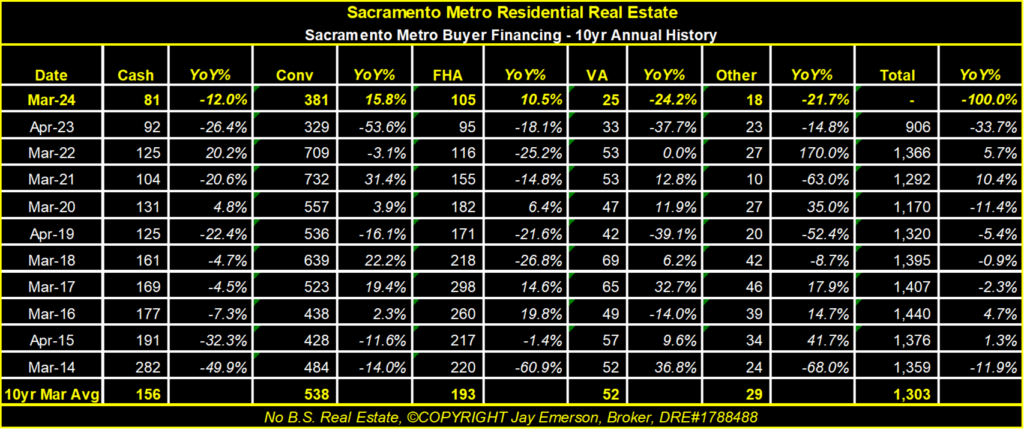

History

Critical data elements for the current month and each of its occurrence for 10 years earlier. The averages are shown to help describe how the current market deviates from average for these data items.

Cash

When a purchase is tallied as a “cash” purchase, it means the buyer used nothing BUT cash. What we don’t know is how much cash a borrower used when they also got a loan.

Conventional

Conventional loans can include any amount of cash combined with their loan. But this is NOT a FHA or VA borrower. Typically accompanied by a 10-20% down payment, additional cash may be necessary in a competitive, seller’s market.

FHA

When the US government guarantees a loan, it gets special uses [and less cash required]. These FHA loans are not always popular with sellers. So, in a seller’s market, these loans decrease in number.

VA

Of the benefits of serving in the US military, eligible veterans can get a 100% loan. These are also not popular with sellers as they come with stringent appraisal and condition requirements that can cost sellers. This preference is stronger in a seller’s market.

Other

When sellers accept an offer that promises [or requests] different financing, such as “owner carry”, it qualifies as Other Financing.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin