Sacramento Metro Real Estate Market

Composite Averages

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

Intro

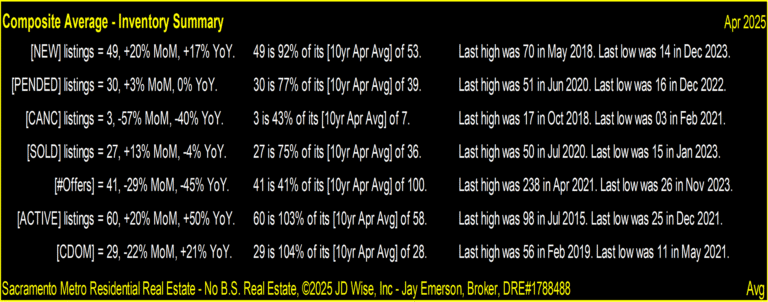

Using raw and monthly MLS data from 52 zip codes, an Average is derived for New, Active, Pended, and Sold listings, the average Cumulative Days on Market, and the average Median Price. The data for the 3 Counties is not part of these Averages.

From this “raw data”, my calculations result in the momentum of each Median Price, the ’10 Yr Mmm Average’ for each data item, ‘Supply’ (New+Active), ‘Demand’ (Pend+Sold), ‘Lean Score’ (long and short-term averages indexed for each data item), ‘Consumption’ (Demand/Supply), ‘Appetite’ (Pend/New), and ‘Turnover’ (Sold/Active).

Inventory

The real estate market was created to exchange “products”: money and houses. When a house is made available to prospective buyers, there is a response to that “Product”. That response can be shown by the current and historic data and the trends and shapes of those lines. An ACTIVE listing is briefly also NEW. When a seller and buyer enter escrow, the “Product” becomes PENDING. If that buyer and seller execute the contract, the “Product” becomes SOLD. The life of all “Products” (MLS only) can be seen in these charts and blurbs.

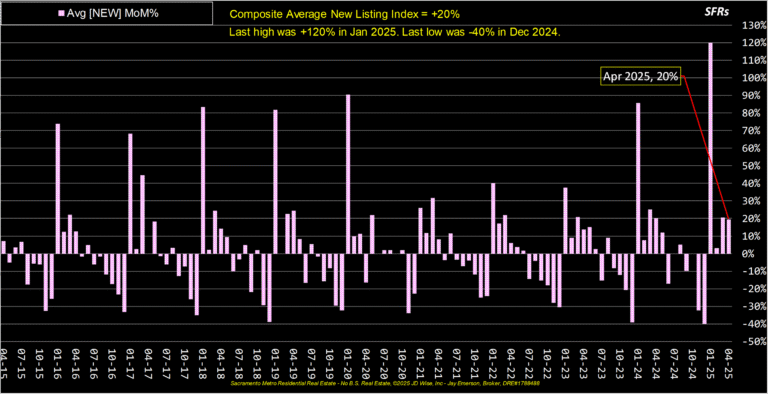

₊[NEW] – entered as a listing during this calendar month.

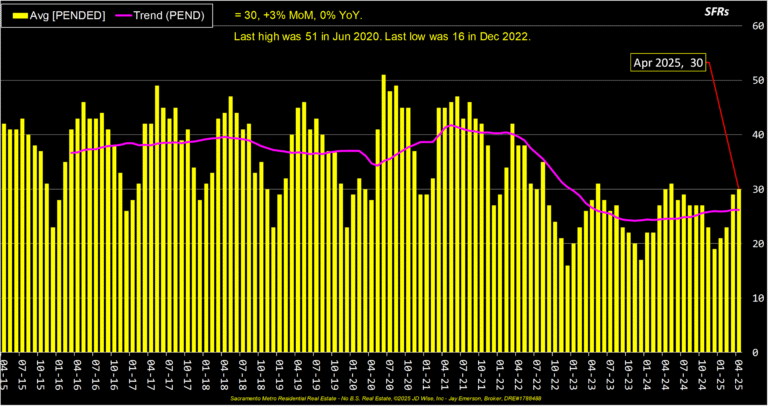

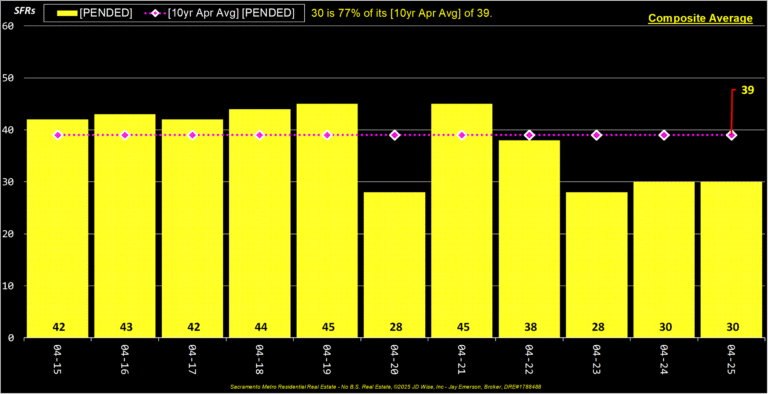

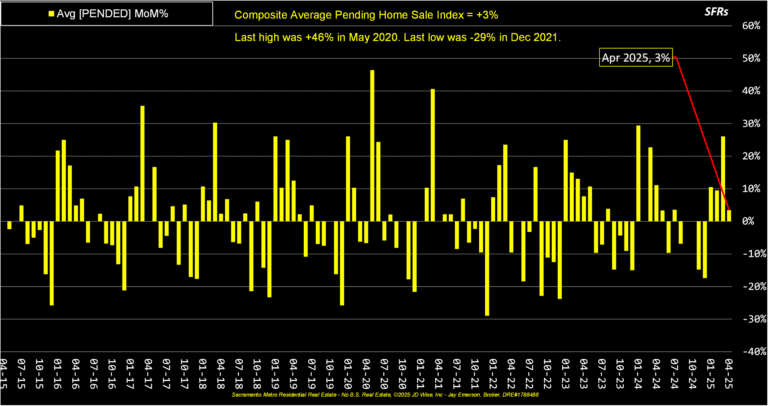

₋[PENDED] – went Pending during this calendar month.

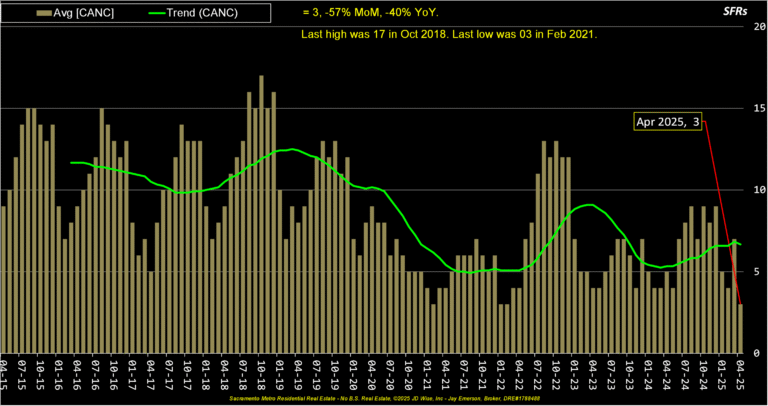

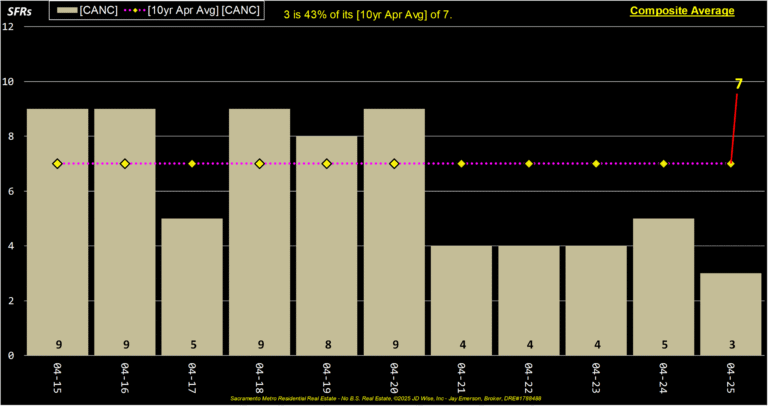

₋[CANC] – canceled or expired during this calendar month.

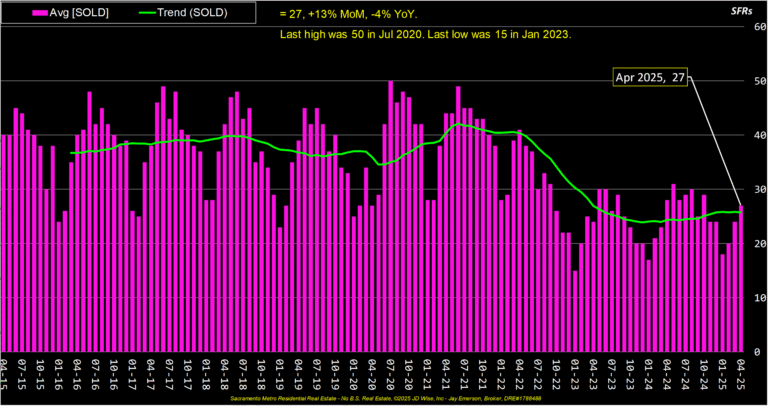

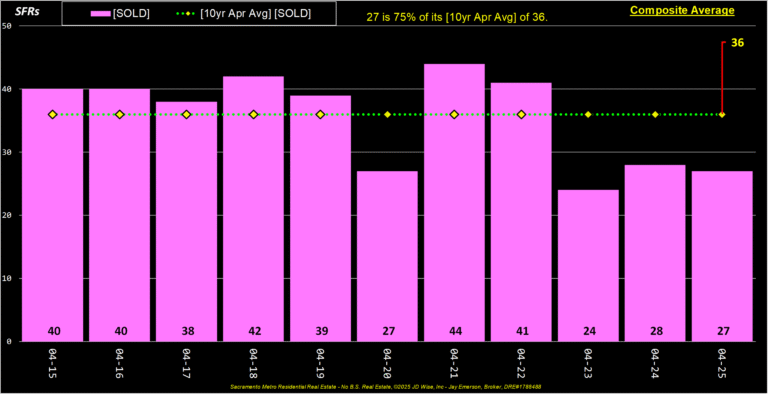

₋[SOLD] – sold during this calendar month.

₋[#Offers] – number of offers for [SOLD] listings.

₌[ACTIVE] – available at the end of THIS calendar month.

NOTE: a [PENDED] listing may have [SOLD], maybe back to [ACTIVE].

NOTE: only [NEW] listings increase the supply of inventory.

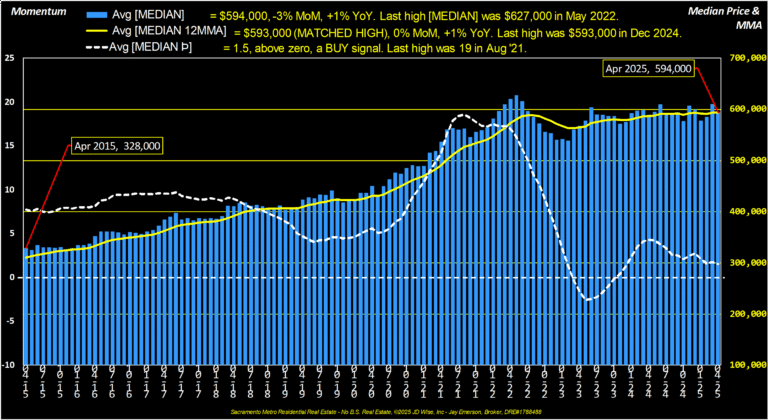

Median Price

The ‘Median’ Price means half of Sold prices were lower and half were higher. The other popular measurement is the ‘Average’ Price. Using the ‘Median’ eliminates the effect of outliers on a meaningful measurement.

The Momentum and the 12-month moving average (12MM), both based on the Median Price, help predict future changes and indicates possible investment actions.

Momentum detects changes in the rate of change from month to month and therefore moves before the Price change is evident. The monthly Price change pulls and pushes on the Moving Average of the Price. For highly variable prices (e.g., Loomis 95650), Momentum and the MA of the Price is more difficult to translate.

12MMA

The 12 Month Moving Average is a ‘trailing indicator’ of the Price that places a greater weight and significance on the most recent data points. Like all moving averages, this technical indicator is used to produce buy and sell signals based on its relation to the Price changes it is measuring. Traders often use several different EMA lengths, such as 10-day, 50-day, and 200-day moving averages. Investment analysis usually uses data with a 1-day occurrence. Real estate data, although happening daily, is reported monthly. Therefore, these calculations use the frequency of source data – monthly, therefore 12 month MA.

https://www.investopedia.com/terms/e/ema.asp

Momentum

Showing the Median Price and its Momentum (Þ) together makes it easier to explain how crossing the X axis “warns” the investor that the momentum is triggering a possible action. Because Momentum is not perfect, there is a time lag and, therefore, lost opportunity to either gain more or lose less from the actual peak/trough to the crossing of the X axis.

Commodity brokers put a heavy reliance on momentum for the underlying price change of the commodity they’re trading. It’s a year-over-year calculation depicting the direction and force of the price change. Maximizing your profits as a home seller requires the exclusive use of TIME to trigger your selling decision.

https://www.investopedia.com/trading/introduction-to-momentum-trading/

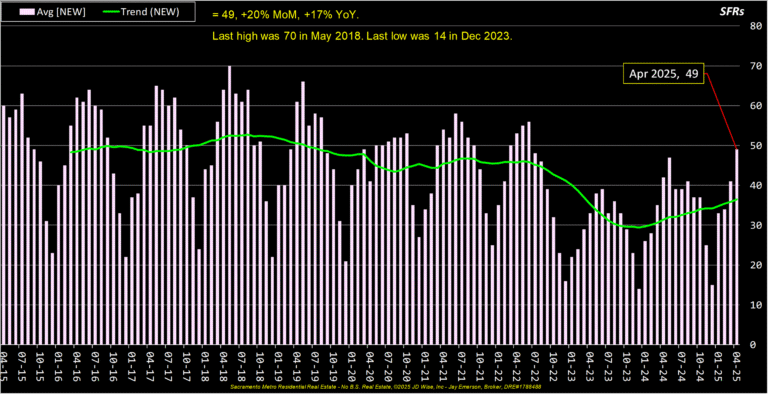

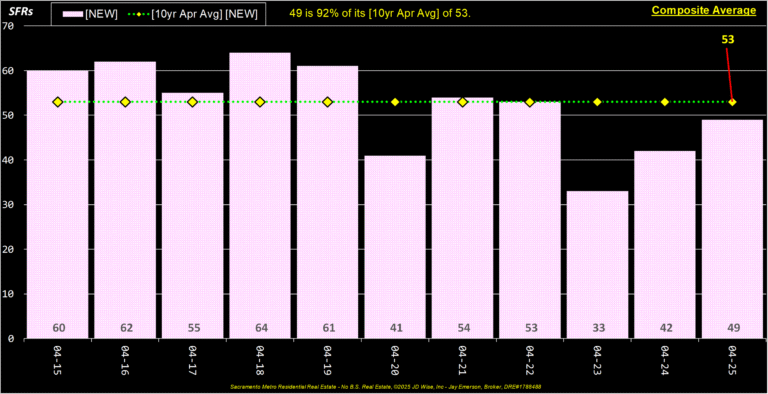

New

Exposed during the calendar month, these listings are “fresh” supply. Without ample supply, prices go up, buyers don’t have much selection, and sellers have less competition.

Pended

Listings that go Pending are those that go “into contract”. These PENDED listings may have sold or may have gone back to ACTIVE.

Canceled

Canceled or Expired, these listings were removed from the market during this calendar month.

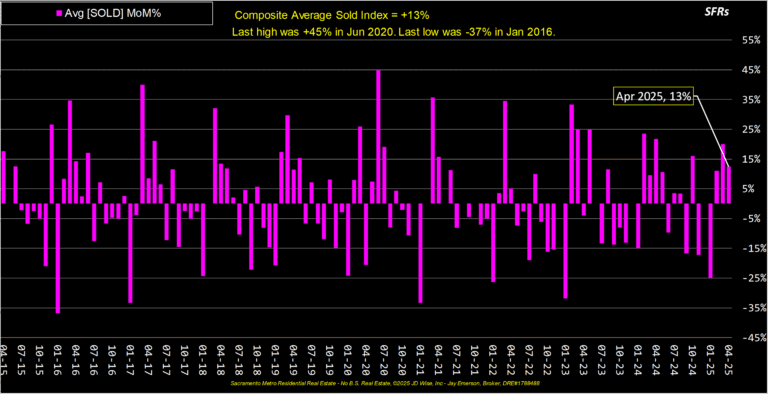

Sold

These listings sold during the calendar month.

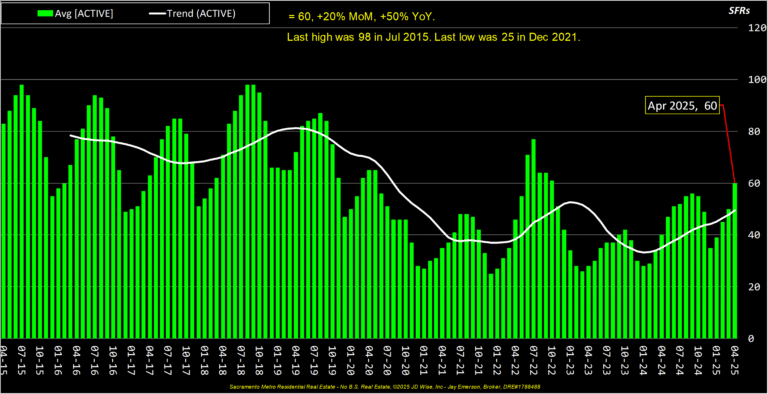

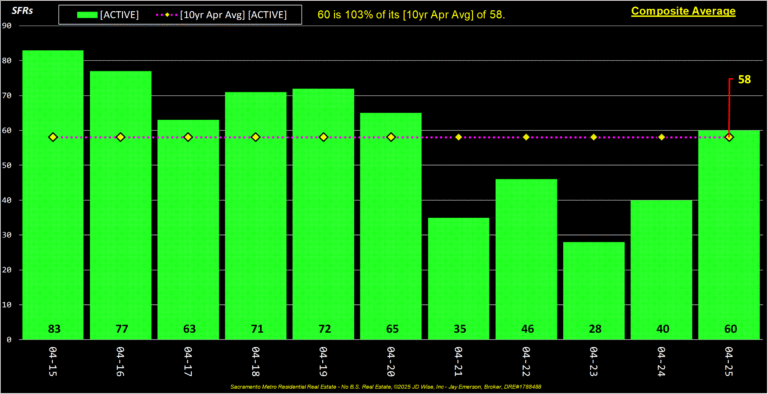

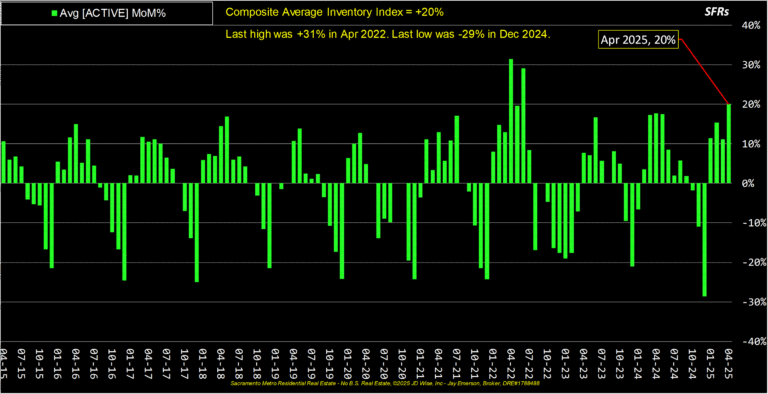

Active

These listings were Active at the end of the calendar month.

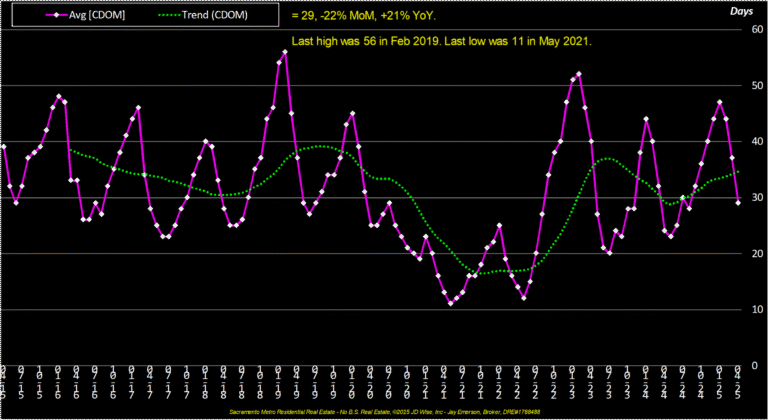

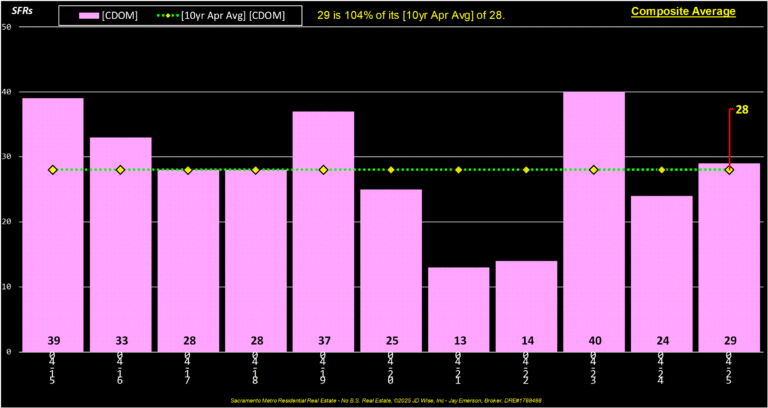

CDOM

Cumulative Days on Market (CDOM) represents the number of days a listing spends ACTIVE until SOLD. The number of days PENDING are excluded from the CDOM number.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin