Home Buyers

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

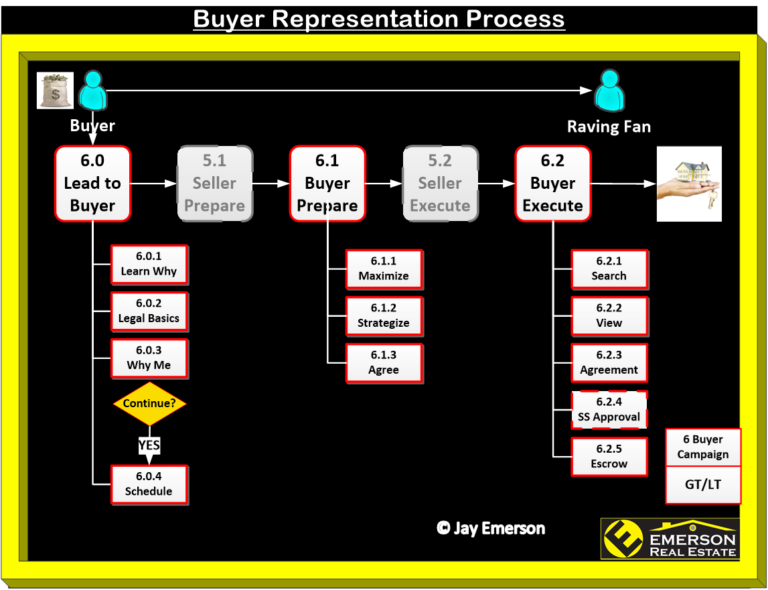

Buyer Process

Buyers must prepare their mindset, family, and product (financing). The process is not complex but it takes and expects diligent performance from all of us.

Candyland, the pictorial of the Buyer Process, explains the fundamental steps. Some steps can be skipped and others cannot.

Use me to start your best strategy.

Your Requirements

You define your time and money rules – you clarify special Family needs and wants – you state your expectations – you define value

Your Plan

Establish your strategy and tactical details – agree on decisions – know plans change

Your Position

Combine your goals with market conditions – understand your position in the market and how you can best win.

Your Qualifications

Find a good loan product and lender. Your purchase funds come from a mix of loan and cash. The hiring choices you make dictate your success.

Your Loan

Sorry we are experiencing system issues. Please try again.

WARNING

The internet is a valuable source of information and opportunity. It is also a place of mis-stated truths to get your money, time, or attendance. Even your website visits (eyes) on some sites enhance their profit potential. That means they are motivated to post SOMETHING, not necessarily the truth. Beware.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin