Sacramento Metro Real Estate Market

Composite Momentum

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

Intro

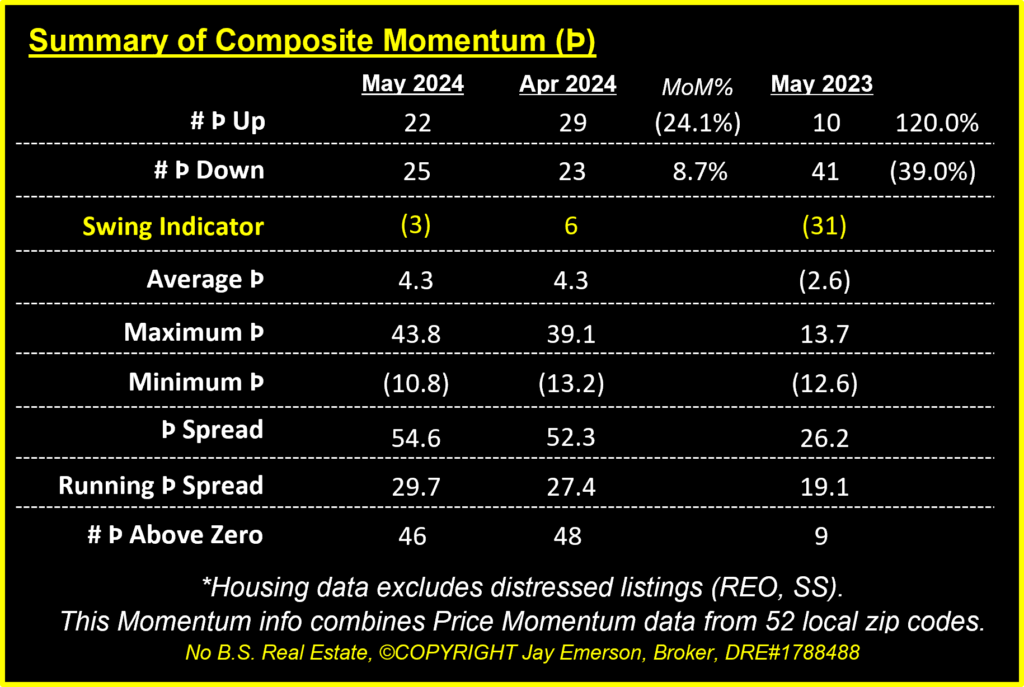

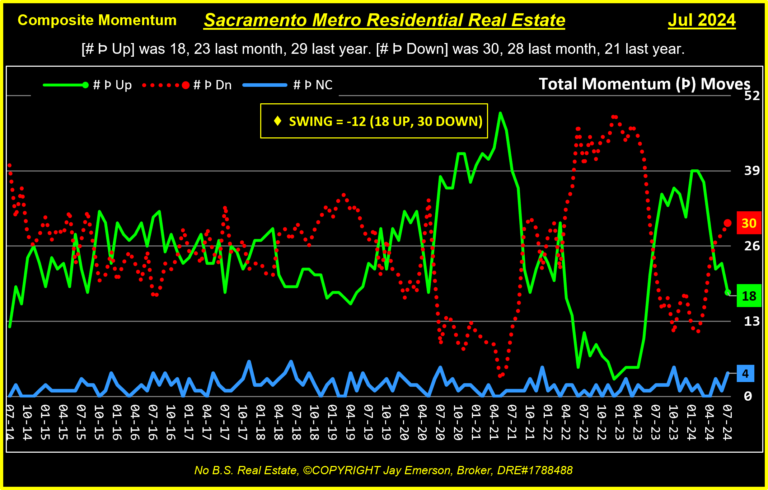

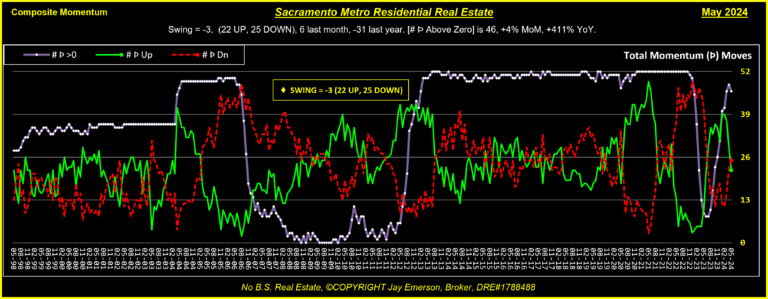

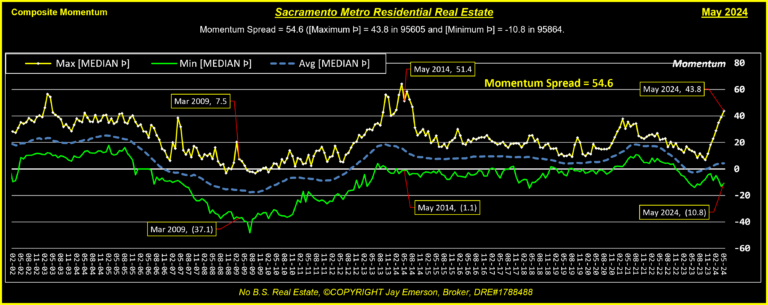

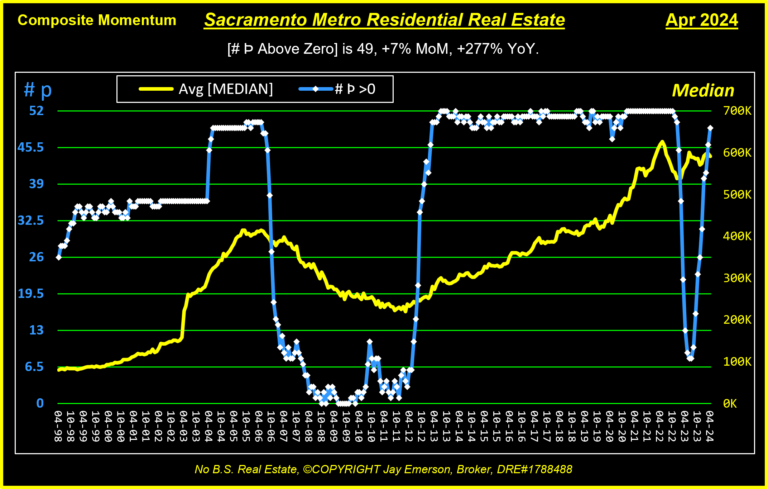

Using data from 52 zip codes, the price momenta are aggregated to show Momentum Swing and Spread. These views depict market movement, price variability, and potential future triggers.

Summary

Swing Indicator

My “Swing Indicator”, similar but not identical to an EKG because of the granular elements (zip codes), tells me when the general direction (via momentum) is increasing, decreasing, or unchanged in the current month. When aggregate momentum is too high or too low, the consequences are usually more of the same.

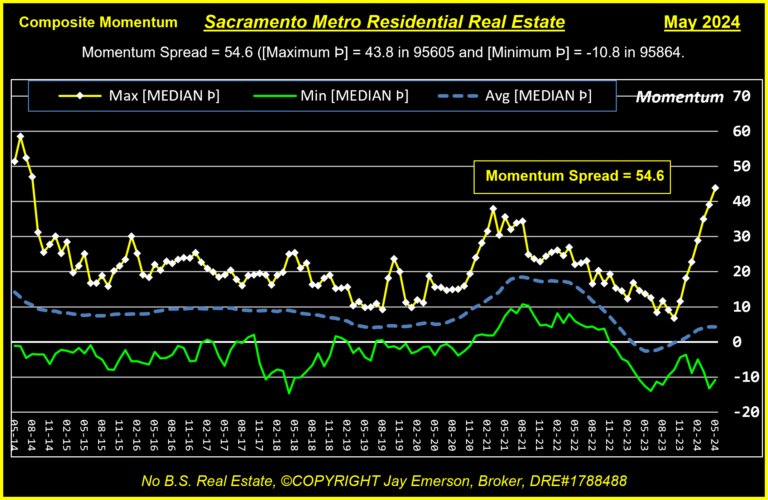

Spread

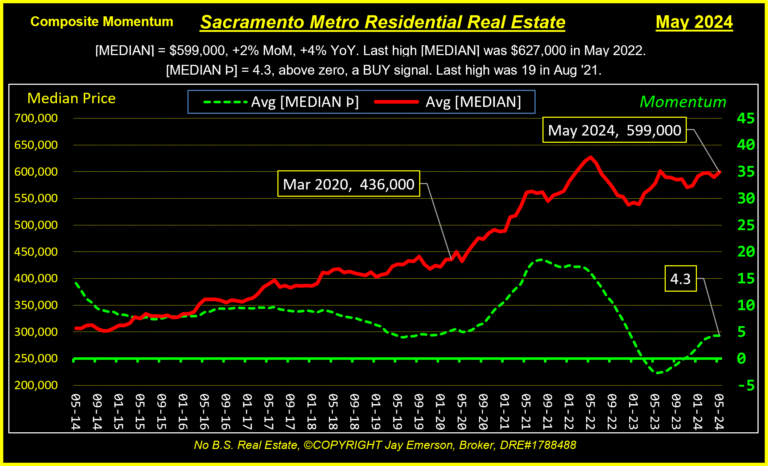

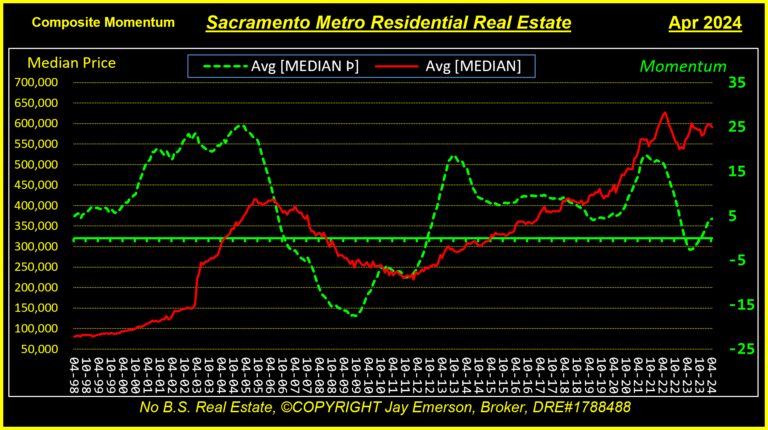

Momentum

There is no perfect indicator of the future direction of prices. Showing the Median Price and its Momentum together makes it easier to explain how crossing the X axis “warns” the investor that the momentum is triggering a possible action. Because Momentum is not perfect, there is a time lag and, therefore, lost opportunity to either gain more or lose less from the actual peak/trough to the crossing of the X axis.

Buy Zone

When a momentum is positive, it indicates a “BUY” for the commodity being measured. And when negative, it indicates a “SELL”. Aggregating all momenta and charting them shows how healthy a market is.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin