Sacramento Metro Real Estate Market

Metro Counties

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

Intro

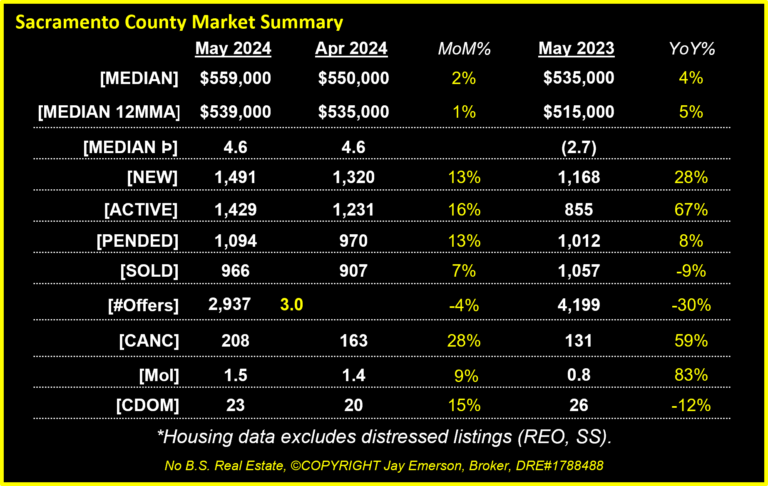

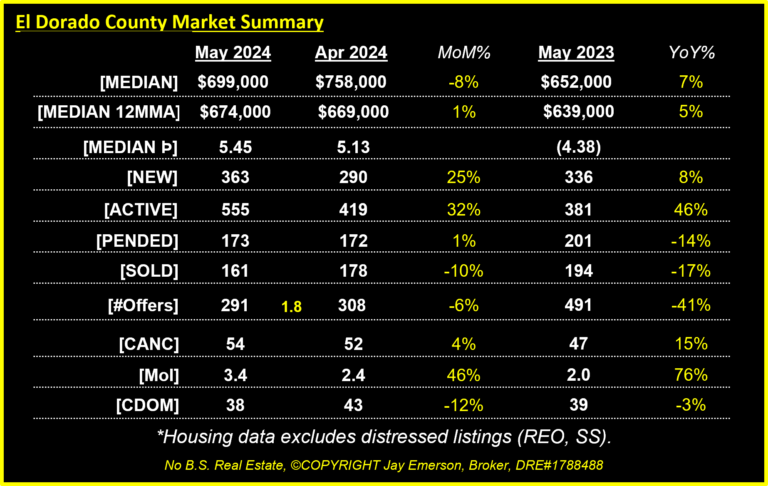

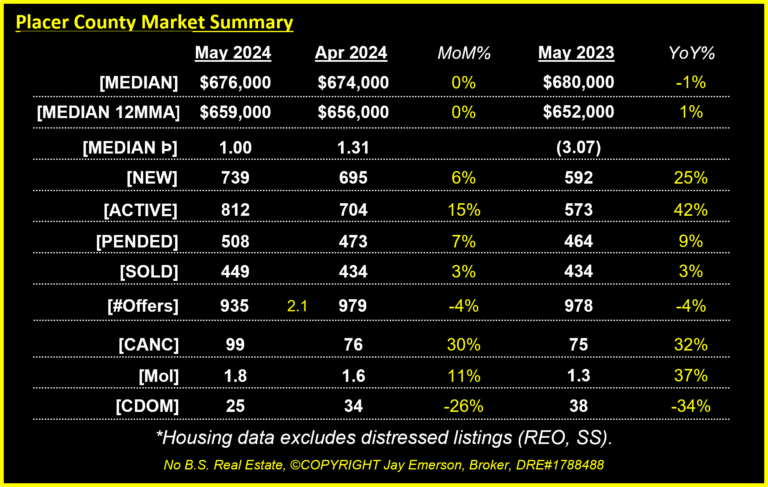

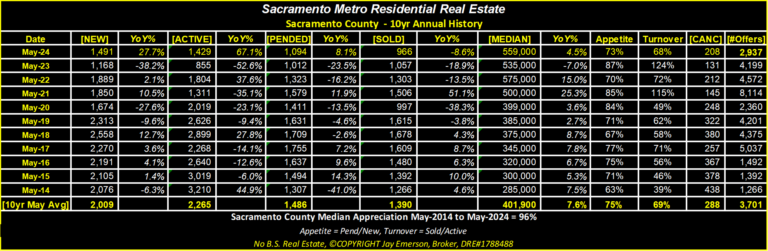

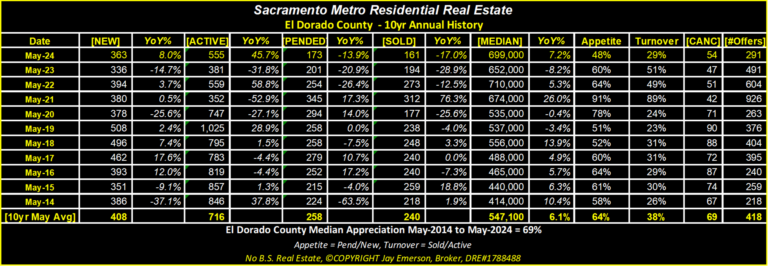

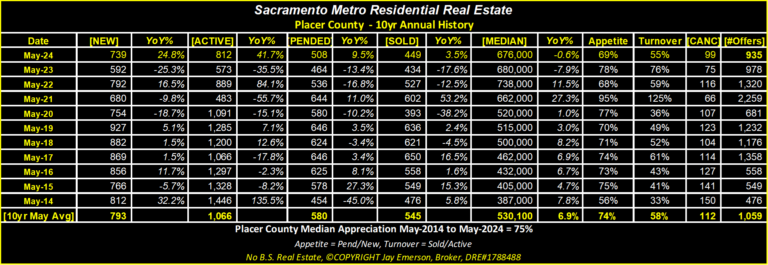

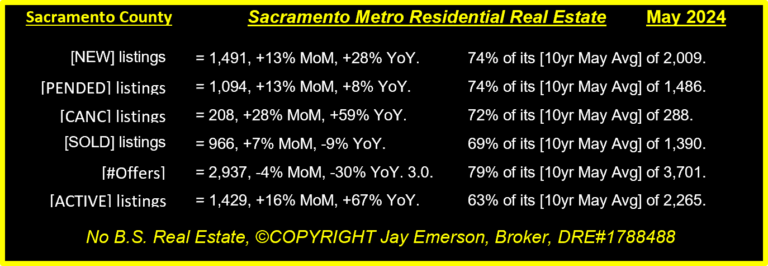

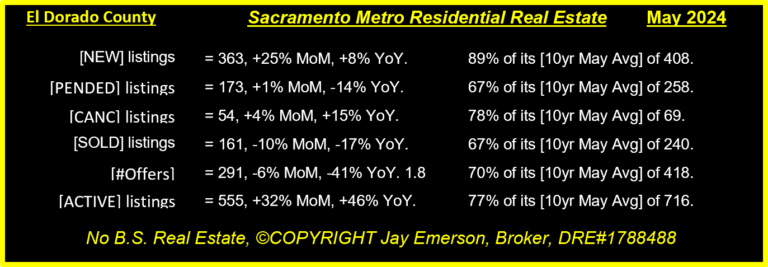

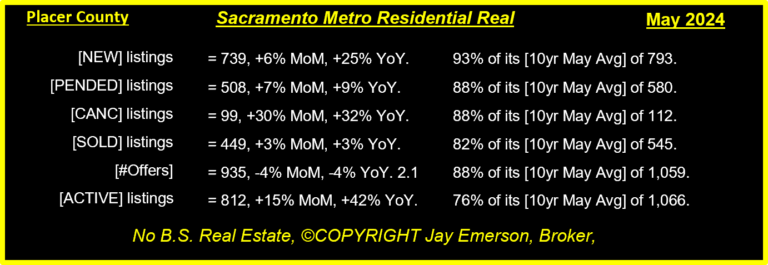

Using raw and monthly MLS data from 3 Counties (Sacramento, El Dorado, Placer) for New, Active, Pended, and Sold listings, the average Cumulative Days on Market, and the average Median Price. The data for the Composite Average is for the 52 zip codes, not these 3 Counties.

From this “raw data”, my calculations result in the momentum of each Median Price, the ’10 Yr Mmm Average’ for each data item, ‘Supply’ (New+Active), ‘Demand’ (Pend+Sold), ‘Lean Score’ (long and short-term averages indexed for each data item), ‘Consumption’ (Demand/Supply), ‘Appetite’ (Pend/New), and ‘Turnover’ (Sold/Active).

Geography

Summaries

History of This Month

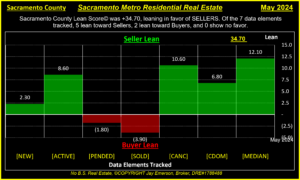

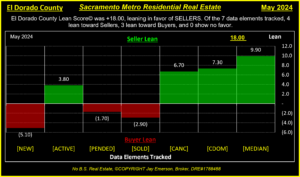

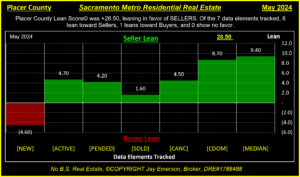

Lean Score

By calculating the deviations between the current data value and its own short- and long-term averages, the LEAN attempts to portray who is favored in the current market.

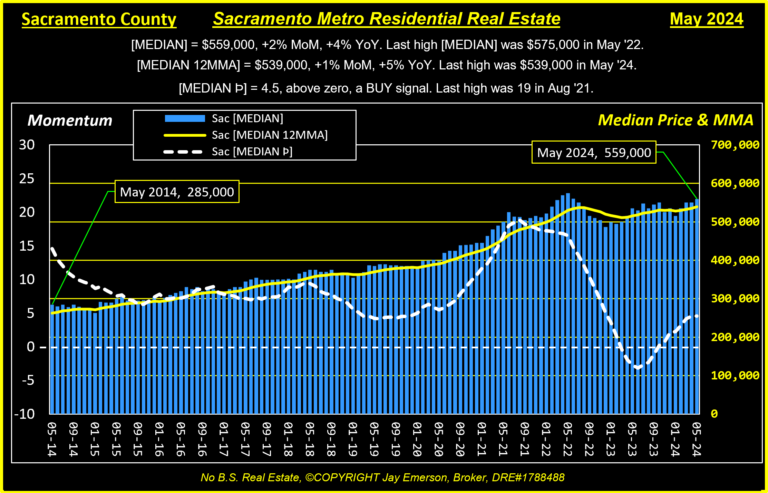

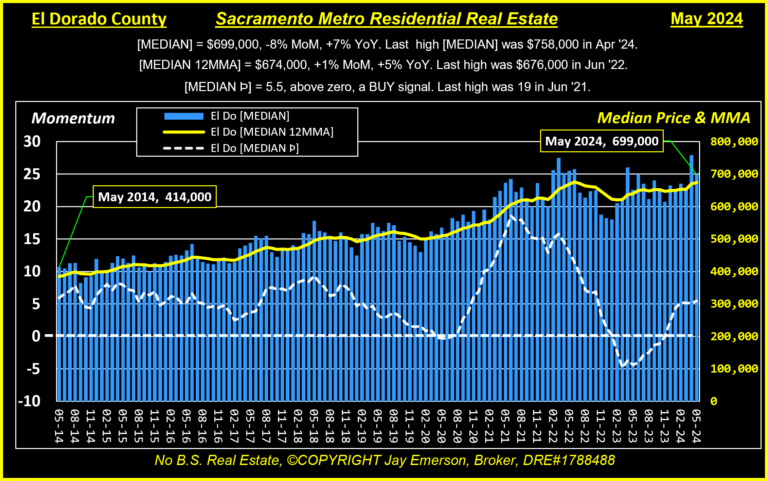

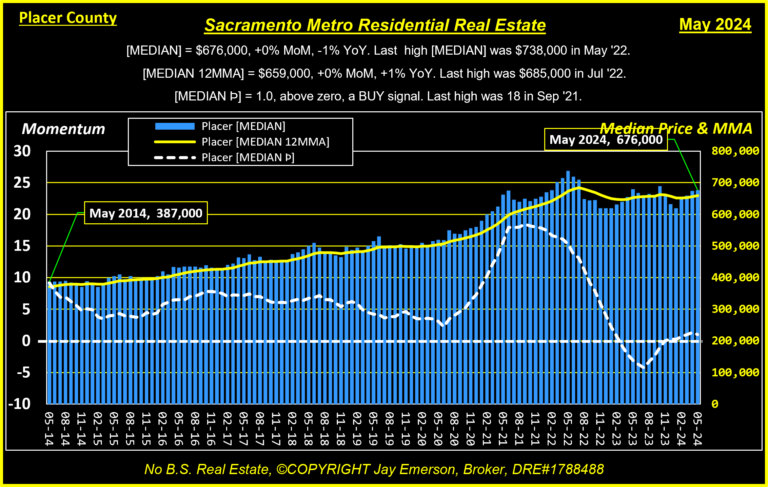

Median Price

12MMA

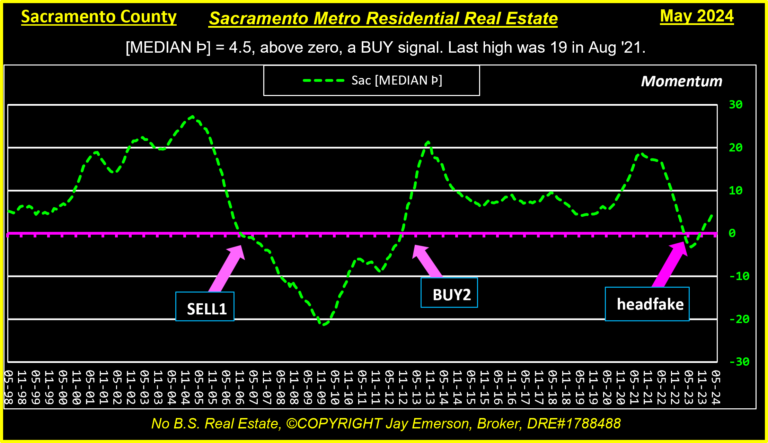

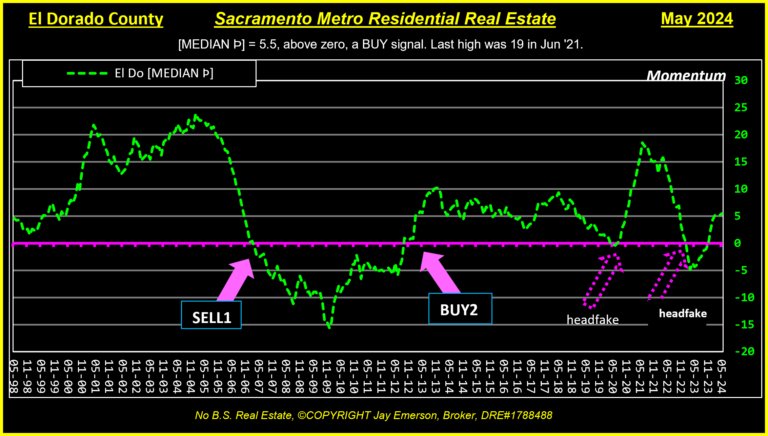

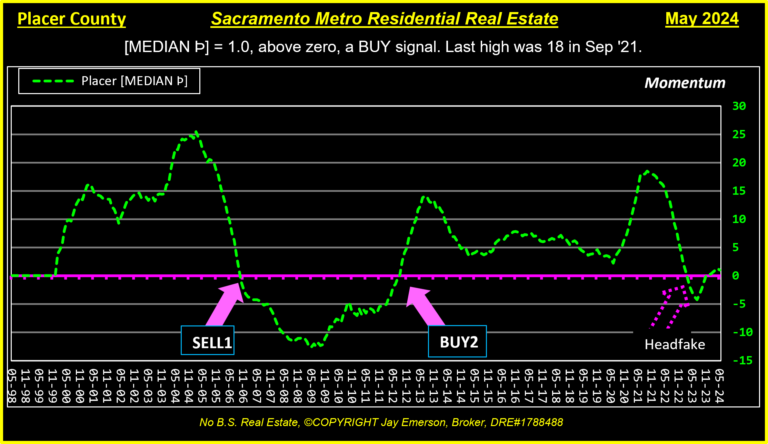

Momentum

Inventory

The real estate market was created to exchange “products”: money and houses. When a house is made available to prospective buyers, there is a response to that “Product”. That response can be shown by the current and historic data and the trends and shapes of those lines. An ACTIVE listing is briefly also NEW. When a seller and buyer enter escrow, the “Product” becomes PENDING. If that buyer and seller execute the contract, the “Product” becomes SOLD. If the seller actively removes their listing, it is CANCELED. If the listing period comes to an end, it is EXPIRED.

The life of all “Products” (MLS only) can be seen in these charts and blurbs.

The data for New and Pending listings render this calculation called “appetite” for new residential listings for the month.

The data for Active and Sold listings render this calculation called “turnover” of residential listings for the month.

Momentum

Momentum Gain

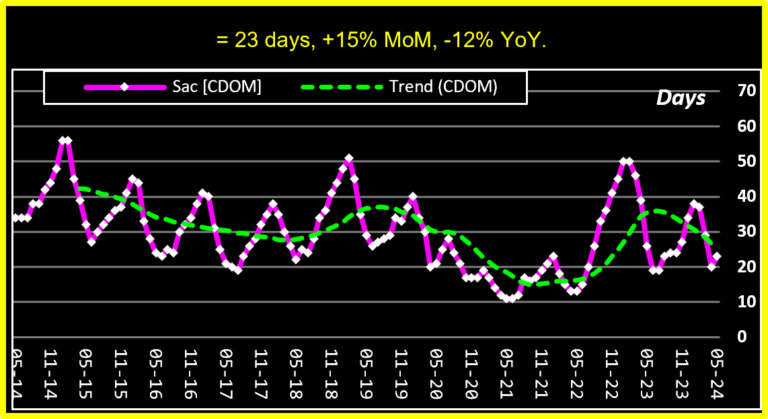

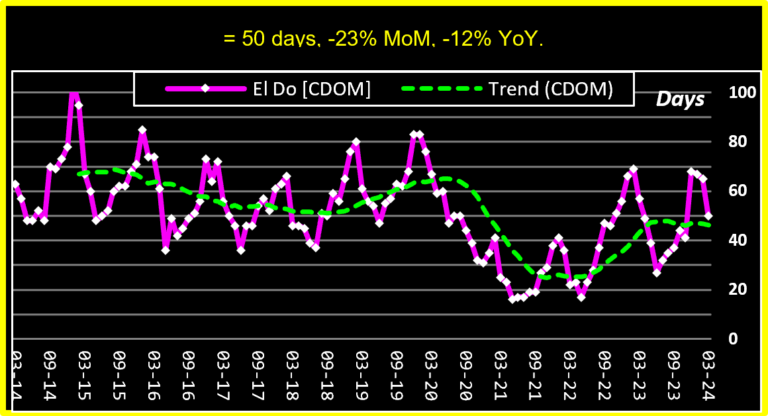

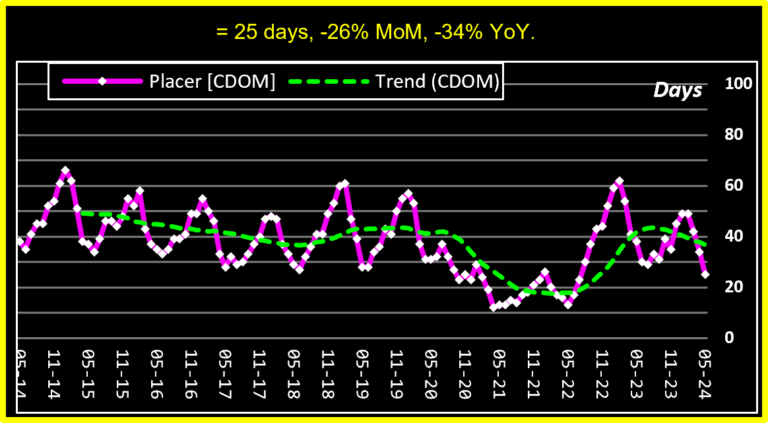

CDOM

Cumulative Days on Market (CDOM) represents the number of days a listing spends ACTIVE until SOLD. The number of days PENDING are excluded from the CDOM number.

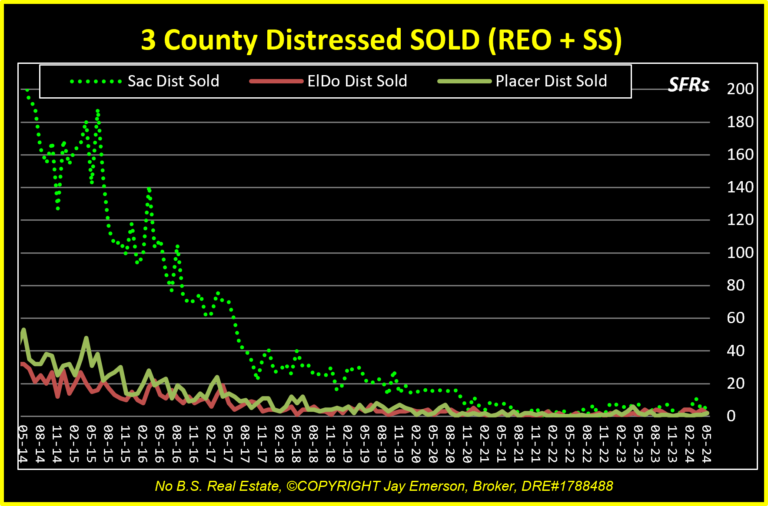

Distressed

When home owners become under-paid, unemployed, and over-burdened, houses can be foreclosed or be sold “short”. This chart shows the volume of “distressed” sales in our 3 counties. A foreclosure frequently becomes an REO (Real Estate Owned) and to avoid foreclosure, sellers can sometimes be allowed by their lender to sell “short” of the loan balance.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin