Sacramento Metro Real Estate Market

Major Forces

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin

Intro

There are many elements (“forces“) that drive the supply (attempt to sell) and the demand (attempt to buy) homes. When a home is newly constructed, there are additional forces. Common to either type of single-family residence (SFR), mortgage rates, buyer and seller confidence, new home permits, and employment exert extreme forces on the supply and demand for homes.

Summary

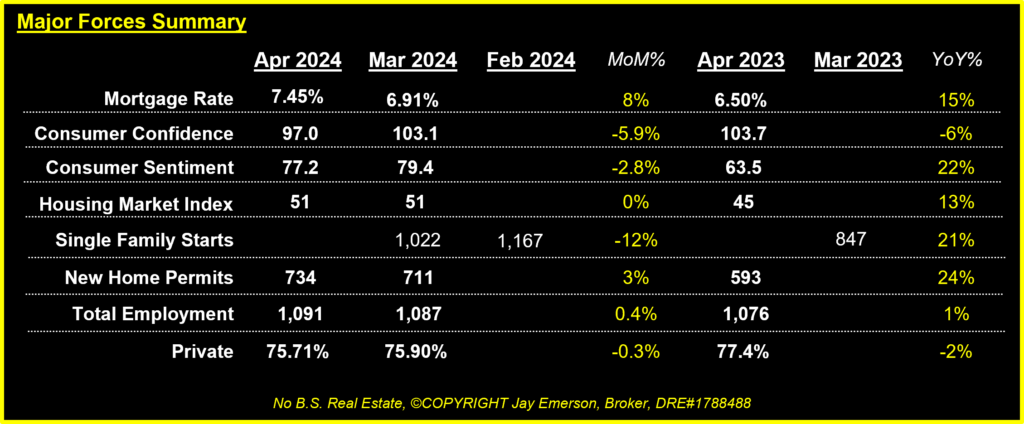

This shows the monthly and yearly changes for Major Forces data which is published on different timelines.

Mortgage Rate

This National mortgage rate data is collected each month from ‘mortgagenewsdaily.com/mortgage_rates/charts.asp’, specifically the Freddie Mac 30yr fixed rate. Low rates trigger demand which, in turn, triggers supply. Buyers who do too much rate shopping 1) won’t improve it much and 2) may affect their success.

Consumer Confidence

This National ‘Conference Board’ data is collected each month from ‘investing.com/economic-calendar/cb-consumer-confidence-48’. High confidence helps demand and supply. Changes in National confidence is, naturally, caused by National forces. Our market may be slightly different, but it’s hard to fight the psychology of humans.

Consumer Sentiment

Consumer Sentiment (national) is created and managed by the University of Michigan. This indicates the level of confidence that surveyors tabulated in their polling.

Housing Market Survey

The NAHB/Wells Fargo HMI is a weighted average of three separate component indices and is described fully here: https://www.nahb.org/News-and-Economics/Housing-Economics/Indices/Housing-Market-Index

Single Family Starts

The NAHB/Wells Fargo Single Family Starts can be found on the NAHB website.

New Home Permits

This Sac Metro permit data is collected each month (but a month behind) from ‘census.gov/construction/bps/msamonthly.html’. Builders buy dirt and add value on it. Buyers can choose a New home or Resale. The supply created by builders isn’t always timed well.

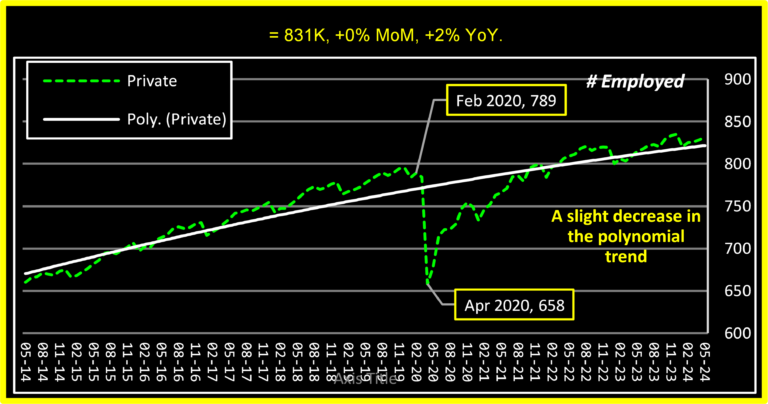

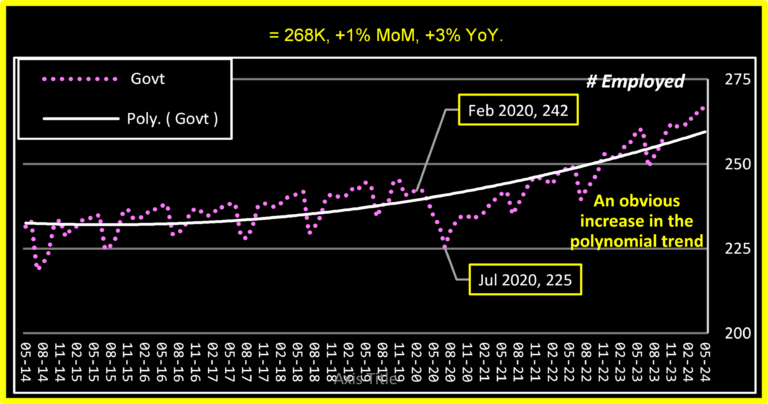

Region Employment

This Sac Metro data is collected each month (a month behind) from ‘data.bls.gov/cgi-bin/srgate’. PRIVATE unemployment is not good for the market. Government unemployment is not as bad because to pay for government, the government has to take private money. A well-run and efficient government could represent as little as 10-15% of total employment; just guessing. A balance of these would be nice. It’s also a taboo subject ESPECIALLY in Sacramento, the seat of California’s government.

-

Zip Menu

-

Fair OaksFair Oaks

-

FolsomFolsom

-

OrangevaleOrangevale

-

CarmichaelCarmichael

-

RosevilleRoseville

-

RocklinRocklin