Bubbles Fizzle

It’s a physical certainty that when hyper-appreciation occurs to any asset or commodity, what follows MUST be hyper-depreciation (“what goes up,…). I wager that an external force could be ‘used’ to disrupt that depreciation. But the physics cannot be delayed forever.

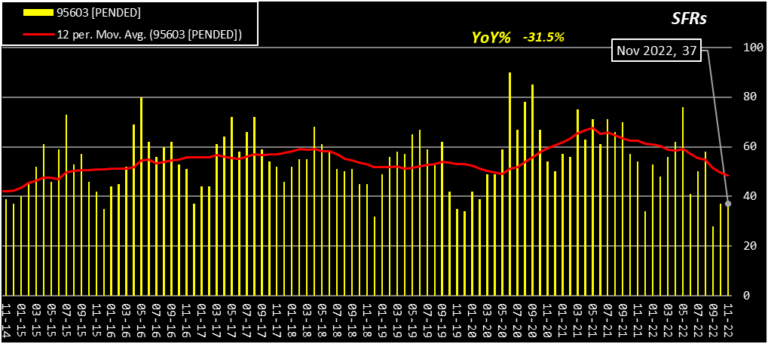

For example, in Auburn, thru November 2022, [PENDED] listings = 37, 0.0% MoM, -31.5% YoY, 84% of its [10yr Nov Avg] of 44.

PENDED listings are the leading indicator of buyer presence, demand, and price elasticity. If a listing becomes PENDING, the “contract price” is not yet known (usually) but a buyer submitted an acceptable offer to the seller. When PENDING falls 31% in a year, and is HALF of the previous 12 months, there is a sudden change to the Psychology and Forces that motivate buyers [and sellers].

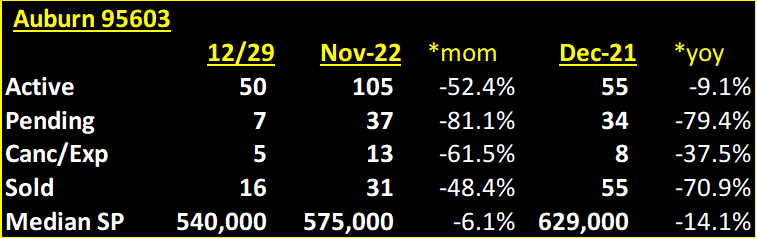

Then, in Auburn 95603 as of 12/29, with 1 work day remaining in December, there are 50 Active listings on MLS (-52.4% MoM, and -9.1% YoY), 7 Pending listings on MLS (-81.1% MoM, and -79.4% YoY), 5 Canc/Exp listings on MLS (-61.5% MoM, and -37.5% YoY), 16 Sold listings on MLS (-48.4% MoM, and -70.9% YoY) and the Median SP of the 16 Sold listings on MLS was $540,000 (-6.1% MoM, and -14.1% YoY).

See how Pending (a PENDED listing may again be another status after going Pending in the month) has dropped TO THE FLOOR?

That reading, still preliminary, is a 79% decrease in PENDING listings since last December. Remember, December 2022, buyers were in the middle of their fear motivation and sellers were laughing all the way to the bank. Notice that the reduction in demand is forcing sellers to accept lower sale prices. That’s how depreciation is manifested – more sellers than buyers and forces that affect a buyer’s purchasing power. The bubble of 2021 has already fizzled in Auburn.

With that new median price, still preliminary, this is how Price, 12MMA, and Momentum would respond; it goes negative (triggering a “SELL” action).

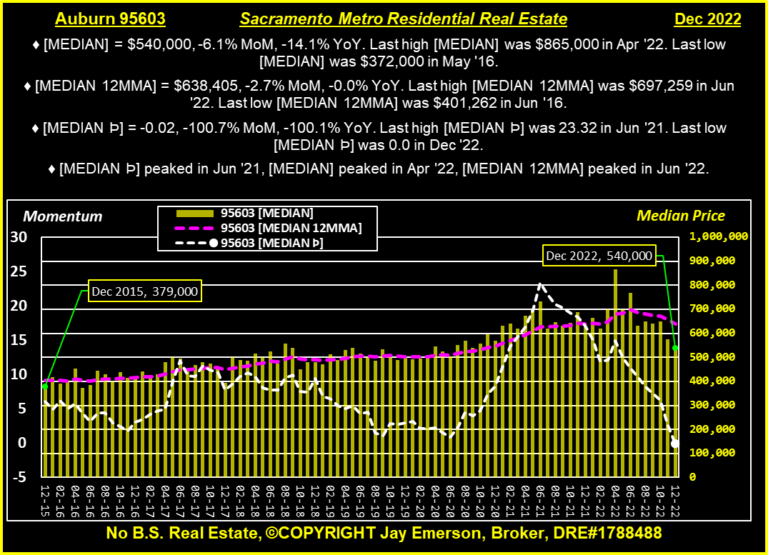

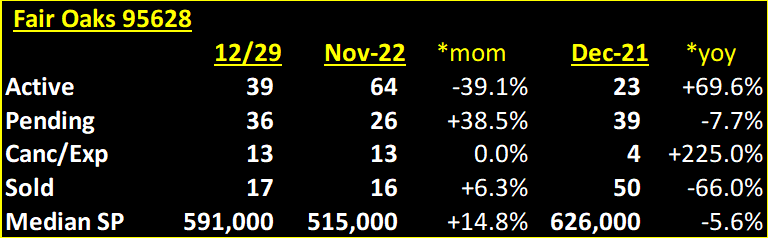

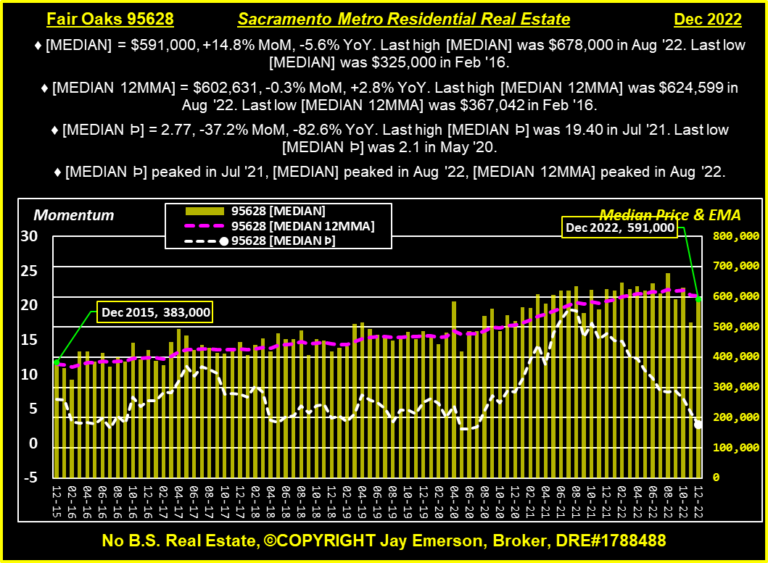

Fair Oaks demand and supply is not different. [PENDED] listings = 26, +30.0% MoM, -45.8% YoY, 67% of its [10yr Nov Avg] of 39.

Then, in Fair Oaks 95628 as of 12/29, with ~0 work days remaining in December, there are 39 Active listings on MLS (-39.1% MoM, and +69.6% YoY), 36 Pending listings on MLS (+38.5% MoM, and -7.7% YoY), 13 Canc/Exp listings on MLS (0.0% MoM, and +225.0% YoY), 17 Sold listings on MLS (+6.3% MoM, and -66.0% YoY) and the Median SP of the 17 Sold listings on MLS was $591,000 (+14.8% MoM, and -5.6% YoY).

That reading, still preliminary, is a 7% decrease in PENDING listings since last December. Remember, December 2022, buyers were in the middle of their fear motivation and sellers were laughing all the way to the bank. Notice that the reduction in demand is forcing sellers to accept lower sale prices. That’s how depreciation is manifested – more sellers than buyers and forces that affect a buyer’s purchasing power. The bubble of 2021 has already fizzled in Auburn.

With that new median price, still preliminary, this is how Price, 12MMA, and Momentum would respond.

Most zip codes and Counties are showing the same reduction in demand and prices. Let me know if you or anyone you know needs a pro. Pricing is key, if you’re looking to sell.

Sac Metro Zip Codes Charted

Fair Oaks 95628 – Folsom 95630 – Roseville 95661 95678 95747 – Orangevale 95662 – El Dorado Hills 95762 – Carmichael 95608 – Citrus Heights 95610 95621 – Elk Grove 95624 95757 95758 – Placerville 95667 – Auburn 95603 – Lincoln 95648 – Rocklin 95677 95765 – Rancho Cordova 95670 95742

(Zip Codes web page) West Sac 95605 – West Sac 95691 – Loomis 95650 – North Highlands 95660 – Rio Linda 95673 – Cameron Park 95682 – Pollock Pines 95726 – Granite Bay 95746 – Arden 95815 – Downtown 95816 – Oak Park 95817 – Land Park 95818 – East Sac 95819 – Elder Creek 95820 – Arden 95821 – Greenhaven 95822 – Franklin 95823 – Fruitridge 95824 – Arden 95825 – College Greens 95826 – Rosemont 95827 – Florin 95828 – Vineyard 95829 – Pocket 95831 – Natomas 95833 – Natomas 95834 – Natomas 95835 – Del Paso Hts 95838 – North Sac 95841 – Foothill Farms 95842 – Antelope 95843 – Arden 95864

Jay Emerson, Broker Masters Club – Outstanding Life Member – DRE#1788488 |