Fair Oaks Market - Dec 2018

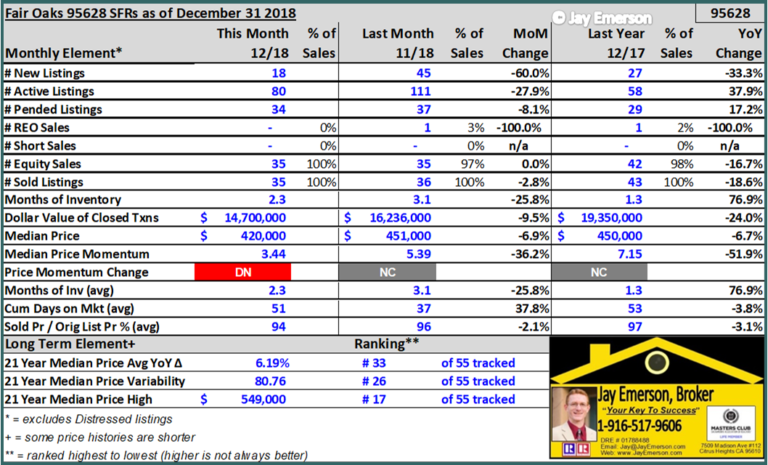

December 2018 is a Seller’s market! The number of Active listings was up 37.9% from one year earlier and down 27.9% from the previous month. The number of Sold listings decreased 18.6% year over year and decreased 2.8% month over month. The number of Pended listings was down 8.1% compared to previous month and up 17.2% compared to previous year. The Months of Inventory based on Closed Sales is 2.3, up 76.9% from the previous year.

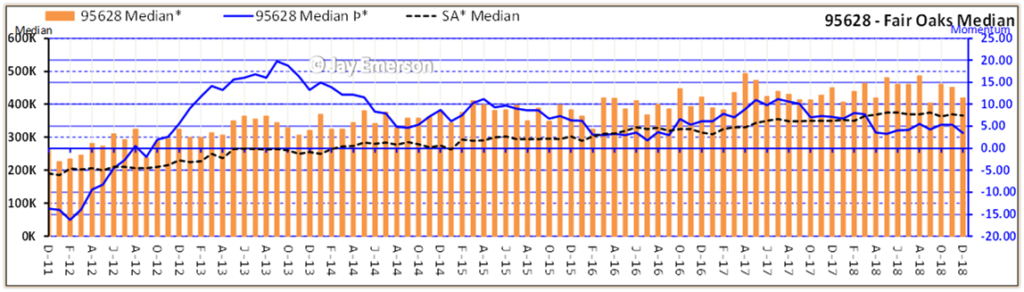

The Median Sold Price trend is “Depreciating”. Momentum dropped 51.9% to 3.44 from a year ago and 36% from last month. The momentum is still in the “buy” zone.

The Average Cumulative Days on Market showed a upward trend, a decrease of 3.8% compared to previous year and a month-over-month increase of 37.8%. The ratio of Sold Price vs. Original List Price is 94%, a decrease of 3.1% compared to last year.

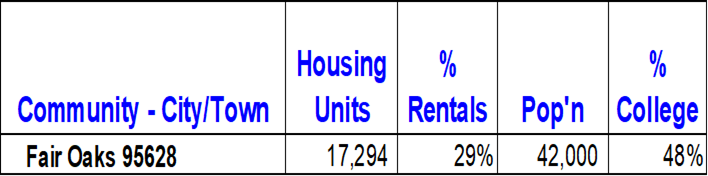

Fair Oaks Facts (2018)

Fair Oaks has about

- 17,294 housing units

- 29% rental units

- 42,000 inhabitants, and

- 48% with some college education

Fair Oaks Momentum

My price charts are based on Median Price of Sold listings rather than the Average Price. Using an Average makes for more variation in the price. A Median better describes the overall depth and breadth of housing being represented. Someone’s opinion may differ from mine.

- Median = half of the prices are higher, half are lower / Average = sum of all prices divided by number of prices

Without charting momentum (symbol Þ), it’s less meaningful and harder to “guesstimate” the future direction and force. Using historical data for this median price, by charting the momentum of changes in that price (and looking backward), it is proof positive that the crossing of the ZERO AXIS is indicative of BUY/SELL, as is shown in this chart and the spreadsheet below. It’s simple math. Let me know what you see.

As goes the general market, so does every zip code. What we can’t know is how the future sales will be appraised and sold. However, my confidence is high that there is always a buyer especially for a 1-story home.

If you or someone you know is looking to buy or sell, I provide excellent service as only a Life Member of the Sacramento Masters Club can provide.

Real Estate Success Factors

When buying or selling a home in California, there are 2 words that every agent needs to understand in order to serve their client well: Risk and Leverage.

Each principal begins with a product. A seller has a house. A buyer has money. To preserve and enhance their respective products, more leverage can be accumulated by: (Seller) ensuring their house is worth its price, and (Buyer) ensuring their purchasing power only gets better.

Leverage is also gathered during the escrow. Sellers can approve repairs. Buyers can remove contingencies on time. There are many activities that can increase a principals’ escrow.

Likewise, a principal can end up with more risk due to an action or inaction. Sellers can “forget” to disclose something about the house or land. Buyers can delay their performance (which is contractual. (The WORST thing that can happen is that one or more principals take leftover risk beyond the closed escrow.

Lawyers exist to claw back monies that are deemed remedies for a principal’s lack of diligence. Sellers are frequently sued for lack of disclosure. Buyers frequently are forced to cancel because of non-performance. But it’s sellers who are frequently left with risk after they sell. Their agent either doesn’t understand Risk and Leverage or it’s a subtle omission that escapes the agent and leaves the Seller exposed without any guidance from their agent.

Success Factor = Ensure your agent can speak Risk and Leverage. These two elements exist before and during the sales process. Leverage can’t serve a Seller beyond escrow but Risk sure can.

Be cautious and manage your Risk and Leverage.

Sac Metro Zip Codes Charted

Fair Oaks 95628 – Folsom 95630 – Roseville 95661 95678 95747 – Orangevale 95662 – El Dorado Hills 95762 – Carmichael 95608 – Citrus Heights 95610 95621 – Elk Grove 95624 95757 95758 – Placerville 95667 – Auburn 95603 – Lincoln 95648 – Rocklin 95677 95765 – Rancho Cordova 95670 95742

(Zip Codes web page) West Sac 95605 – West Sac 95691 – Loomis 95650 – North Highlands 95660 – Rio Linda 95673 – Cameron Park 95682 – Pollock Pines 95726 – Granite Bay 95746 – Arden 95815 – Downtown 95816 – Oak Park 95817 – Land Park 95818 – East Sac 95819 – Elder Creek 95820 – Arden 95821 – Greenhaven 95822 – Franklin 95823 – Fruitridge 95824 – Arden 95825 – College Greens 95826 – Rosemont 95827 – Florin 95828 – Vineyard 95829 – Pocket 95831 – Natomas 95833 – Natomas 95834 – Natomas 95835 – Del Paso Hts 95838 – North Sac 95841 – Foothill Farms 95842 – Antelope 95843 – Arden 95864

Jay Emerson, Broker Masters Club – Outstanding Life Member – DRE#1788488 |