Market Update

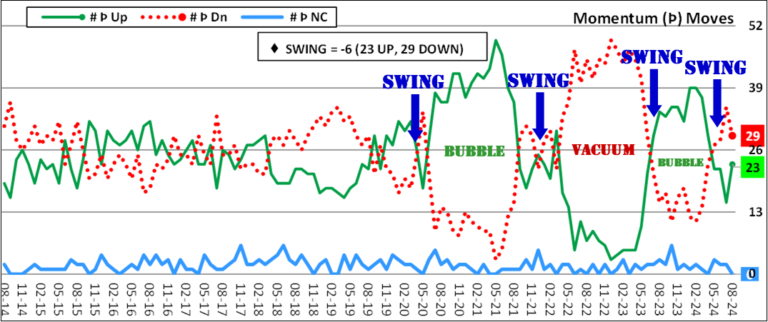

Composite Momentum “Swing”

The momentum of a median price can go up, down, or remain unchanged. Professional traders use momentum of a commodity’s price to indicate their next action.

What a single price momentum CANNOT show is the Bubbles and Vacuums that are obvious when all (52) price momenta are shown.

This proprietary chart includes annotations to show the Bubbles, Vacuums and Swings are. The extended period of no extremes (2015-2020) tells me the market did not experience any extremes triggered by fear or indicating an ‘exodus’ of sellers. There were multiple-offer situations (nothing like 2021) and price appreciation was 6% per year. Then mortgage rates, insurance issues, regulations, homeless squatters, erosion of private and full-time employment, and other forces created serious bubbles which are followed by vacuums.

Whatever you think about your individual economy, the general malaise has not ended for many. And whatever you think about the impact a change like Trump, we need it more than ever. All I ask is that you use reason and logic that has been missing and is still being depleted. Young voters may not believe those in leadership positions. And why should they? The entire planet wants us to be the shining light on the hill. We have lost our way and must re-take the hill

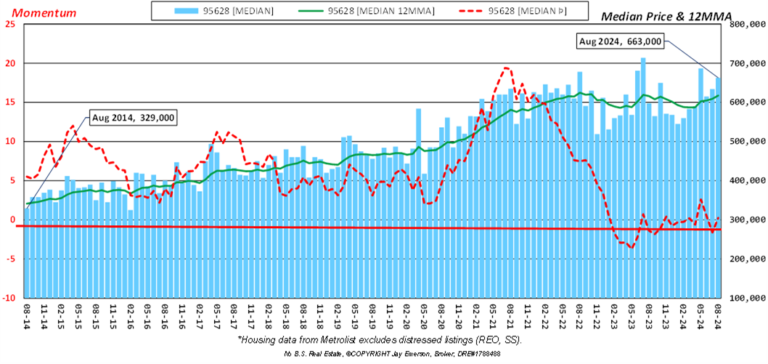

Fair Oaks Median and Momentum

The Fair Oaks median price, its 12-month moving average, and its momentum are charted below. Median price, as indicated by its momentum, spiked when the lockdowns created a fear (FOMO) in buyers. The psychology of buyers quickly created a flurry of sales BUT sellers were motivated to NOT list their houses (or the CA exodus exhausted normal inventories).

Low inventory causes prices to increase. But momentum is proof that the price has not found a trend. Election year and unknown mortgage rate changes are giving some buyers and sellers pause.

[[MEDIAN] = $663,000, +5% MoM, +11% YoY. Last high [MEDIAN] was $714,000 in Jul ’23.

[MEDIAN 12MMA] = $618,000, +1% MoM, +0% YoY. Last high [MEDIAN 12MMA] was $625,000 in Aug ’22.

[MEDIAN Þ] = 0.25, above zero, a BUY signal. Last high was 19 in Jul ’21.

[MEDIAN Þ] peaked in Jul ’21, [MEDIAN] peaked in Jul ’23, [MEDIAN 12MMA] peaked in Aug ’22.

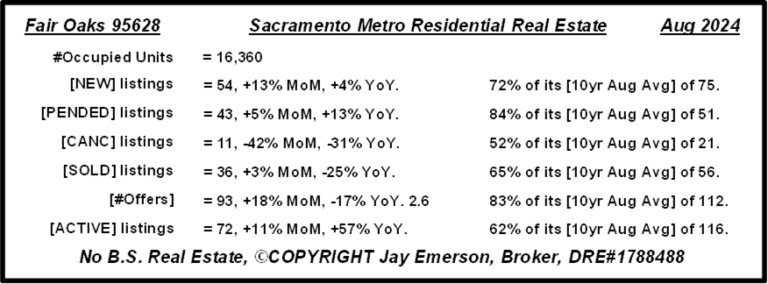

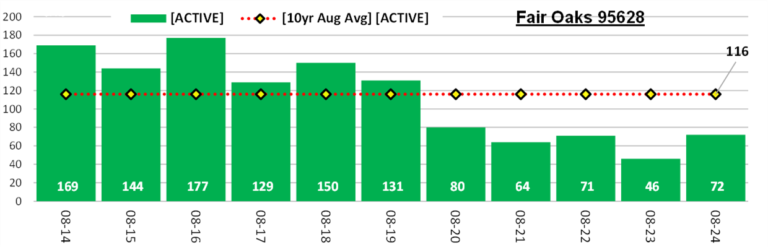

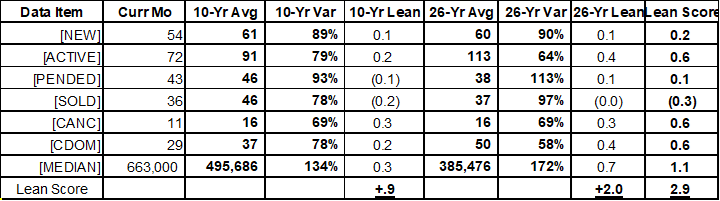

Activity and Inventory

Fair Oaks 95628 ended July with 75 [ACTIVE] listings, in August, added 54 [NEW] listings, 43 went [PENDED], 11 were [CANC], and 36 [SOLD] in August, leaving 72 [ACTIVE] listings at the end of August. Activity is still low and inventory is paltry. Because there are 72 Active and 36 Sold, the “Months of Inventory” is 2.0 (Sellers Market).

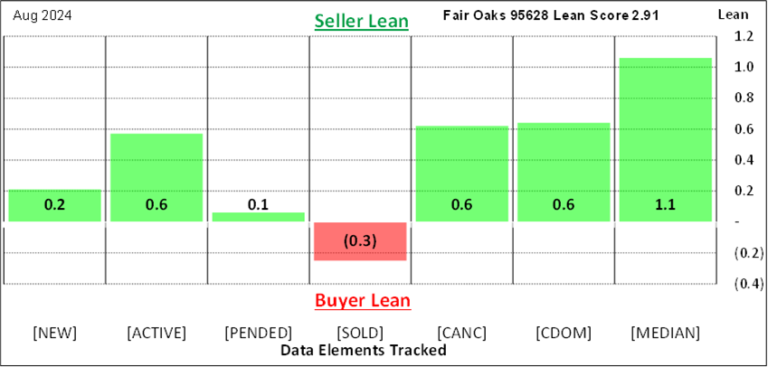

Lean Score

The intent is to show “who is favored”. As a seller’s house starts as a [NEW] listing, becomes [PENDED], and then likely [SOLD], each “phase” represents a result of supply and/or demand. At the end of the month, remaining inventory of [ACTIVE] and even [CANC] (canceled) help tell the story of activity. These are all statuses that a listing will be in the life of that listing (but never at the same time). So the mass and movement of a market’s listings through each status is important to the story. We have to go beyond “Months of Inventory”, although the resulting conclusion could be identical.

When comparing historical data for each “phase” a listing traverses, calculations help tell the story of how that data item is “leaning”, whether toward sellers, buyers, or neither.

For example in August, Lean Score© was +2.9, leaning in favor of SELLERS. Of the 7 data elements tracked, 6 lean toward Sellers, 1 leans toward Buyers, and 0 show no favor. (last month included a weight factor of 10, would have been 1.9)

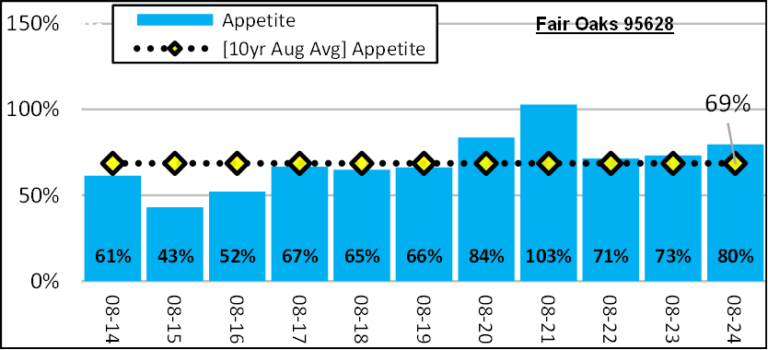

What About Demand?

The news channels, prognosticators, pundits, and savants have been talking about the “lack of supply” which started in the lockdowns (and rate increases). But nobody has talked about the diminishing number of buyers (Demand). Demand can be shown in the volume of SOLD, number of Offers, and Days on Market. Even before a home is SOLD, however, I have developed a simple indicator that is calculated based on the early days of a listing. When a listing is NEW, the interested buyers may see it immediately or after some delay.

Blatant Reparations

Our government agencies, for the most part, are not intended to produce a positive outcome. Their intent is to “govern”, not “boost” activity. If you think that’s a false statement, then you have frequently [or once] seen quantified returns (measurements) based on a ‘bond’ or ‘spending’ led by the government. Have you seen anyone measure the benefits of using our money? Have you heard of the Chevron Doctrine?

An omniscient previous administration created the Consumer Financial Protection Bureau (CFPB) as an element of the Dodd-Frank Act. Liz Warren created the Bureau but wasn’t picked to run it. That was the only catastrophe averted.

The CFPB has never won support of the industry. Rather, the CFPB has replaced Buyers and Sellers in a residential purchase transaction. That is, after a Buyer and Seller come to agreement, the CFPB is allowed to ‘kill’ the deal as though their decision is the most important.

Based on their own survey data, the intent of the CFPB was to ‘repair’ racial disparities among the 10% of adults who don’t have a credit report. Get that? If you don’t have enough or any credit, this agency was created to change that. Regardless of your income or wealth generation, we all now have a ‘right’ to a credit score. National Credit Reporting Agencies (NCRAs) are ‘making people credit invisible’.

This has made the general real estate market much more difficult for Buyers. And if things are difficult for Buyers, they become difficult for Sellers.

Imagine if this process, focused on the goals and intentions of Buyers and Sellers, becomes handicapped by outside entities who only want to change the races in the mix. And the oversight of their actions have resulted in many violations (Chevron Doctrine) and falsehoods made in support of the Bureau. The Bureau has already been caught greatly overstepping their lawful boundaries—see the Chevron Doctrine.

It’s a good thing I’m 1/1024th Blackfoot.

Jay Emerson, Broker Masters Club – Outstanding Life Member – DRE#1788488 |