Evidence of Bonkers

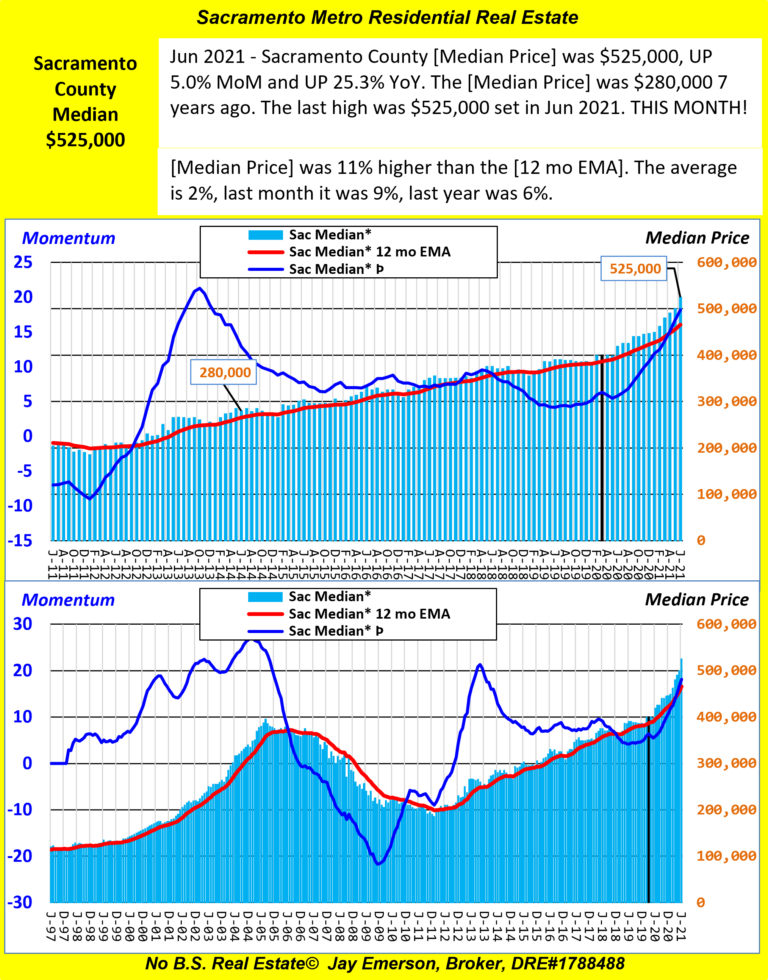

Most Realtors represent buyers and sellers of existing single-family homes. The market provides data that helps navigate the market, up or down. Sellers currently attract eager (“fearful”) buyers who get accommodating appraisers when prices set recurring monthly highs.

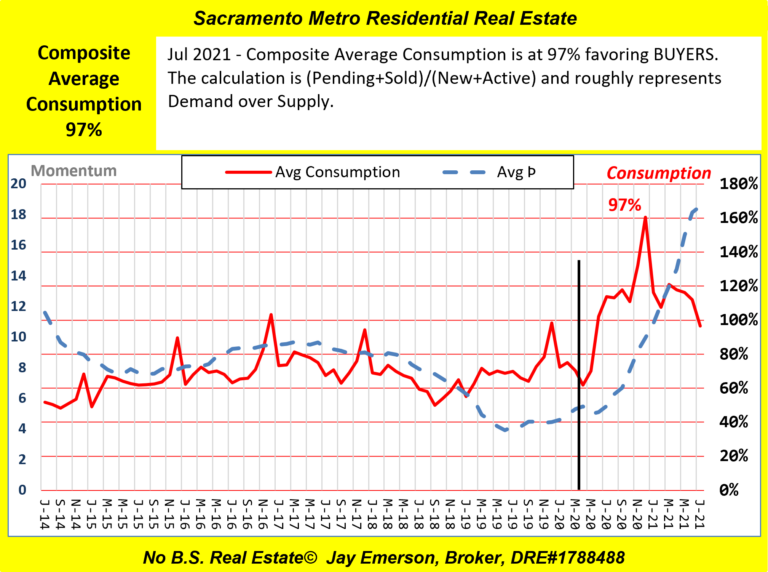

“Bonkers” is a word frequently used since summer 2020 when the run started. (Funny that all lockdown efforts were defied by market participants.) But that is when the hockey sticks started in every county and zip code. My composite depiction of “consumption” shows when “bonkers” started. (The beginning of the Scamdemic is marked in March 2020.)

Data, when not tainted or skewed by the story-teller, can show the market response to supply and demand. These forces produce “market value”. When demand is high and supply is low, prices go up.

But most people know that ‘what goes up, must come down’. And even our brief understanding of the data proves this theorem. The cycles are obvious at the highest level and even seasonal cycles are obvious.

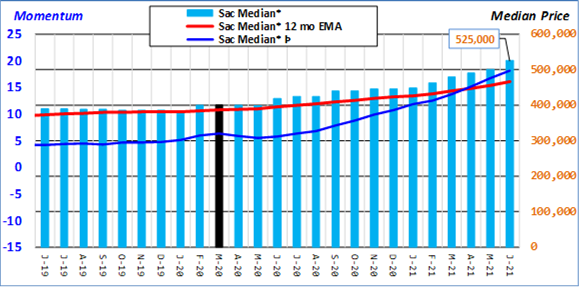

It has also been a human endeavor to guess when the next cycle is coming. Stock and commodity analysts use a 200-day moving average in comparison with the asset price to predict the decreasing differences in these two numbers.

The EMA (Exponential Moving Average) used to calculate Median Price Momentum is charted below to show how the difference between Median Price and 12-mo EMA show minute changes that can be predecessors to a change. The gap between Price and EMA is not going down.

“…insightful and motivated sellers eager to cash out at these ridiculous prices must find a buyer of the opposite persuasion who thinks they’re getting a deal, which is what makes a market.”

A market that is not corrupted by government regulations finds equilibrium. Supply and demand, if left to its own, will stabilize prices. Demand is not infinite. Out of woodwork does not come buyers. (Ironically, woodwork DOES produce supply.) When demand slows and supply builds, prices return to earth.

When trends become permanent, trends they are not. The data is not yet showing an end to “Bonkers”.

There will come a time when good jobs beget true value. Until then, hold on tight.

These are the zip codes that have specific charts on this website:

- Fair Oaks – https://jayemerson.com/fair-oaks/

- Folsom – https://jayemerson.com/folsom/

- El Dorado Hills – https://jayemerson.com/edh/

- Carmichael – https://jayemerson.com/carmichael/

- Orangevale – https://jayemerson.com/orangevale/

- Roseville – https://jayemerson.com/roseville/

- Citrus Heights – https://jayemerson.com/citrus-heights/

Please go to https://jayemerson.com/blog/ and subscribe in the right sidebar.