Sacramento Metro Real Estate Market Update - 2008 December

No B.S. Commentary

2008 created a lot of fear and, for some, a lot of stress. But we will all get through it without living under a bridge as a result. Real estate is still the best investment on Earth. Like any investment, someone has to get bad news. But that’s what the newspapers hope for. Without bad news, there wouldn’t be anything to print. My key learning for the year is that given sufficient education, people will accomplish great things. The greatest accomplishments are possible when competition is scarce which is when others are running away. Do you run away from opportunities?

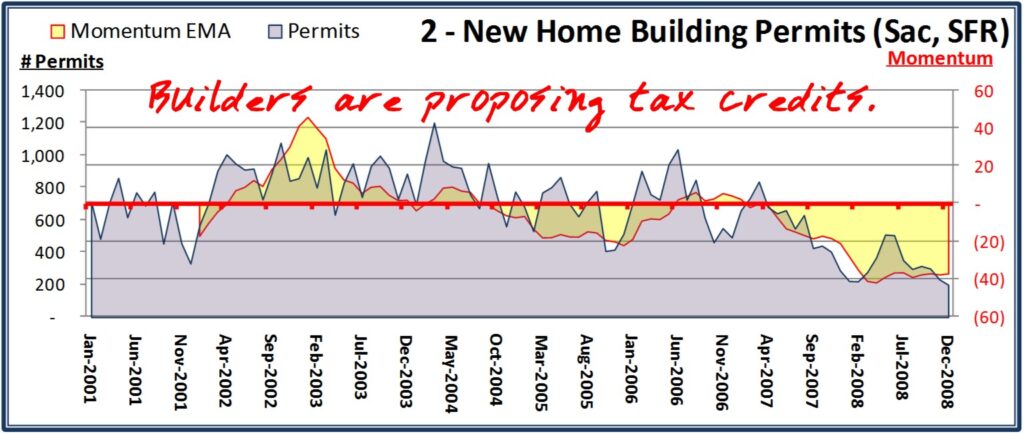

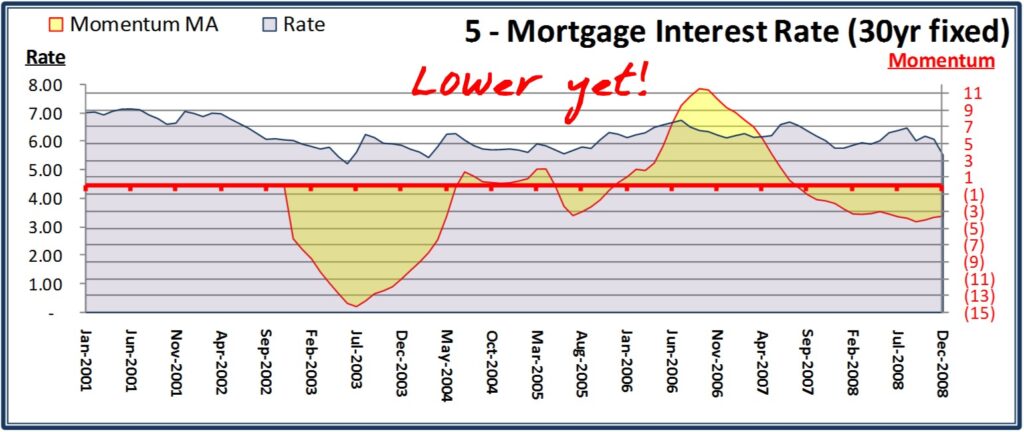

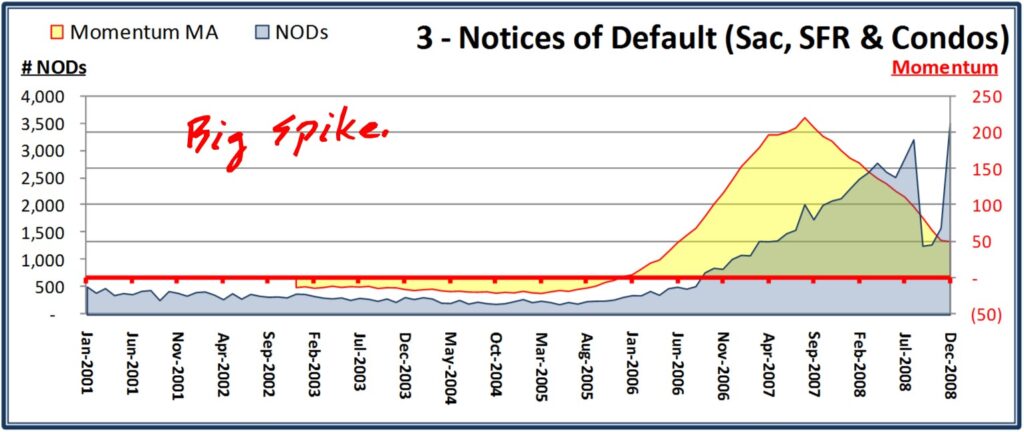

Banks have the bulk of listings on the market and there are more coming. December was a big month for Notices of Default (NODs) which means most of those will be foreclosures (REOs) in 2-4 months. Municipalities want to levy fines on owners (Banks) who neglect their homes. Buyers who buy REOs can possibly qualify for a tax credit. Buyers who buy NEWLY constructed homes, it is proposed, will also qualify for a tax credit. The direct lenders are trying to rebuild their performing asset bases. Mortgage rates are tremendous. The math is simple: Money is available, sellers are motivated, and buyers are getting deals and incentives. Some of the tax credits will be temporary, however. Don’t sit on the fence and watch this opportunity pass you by.

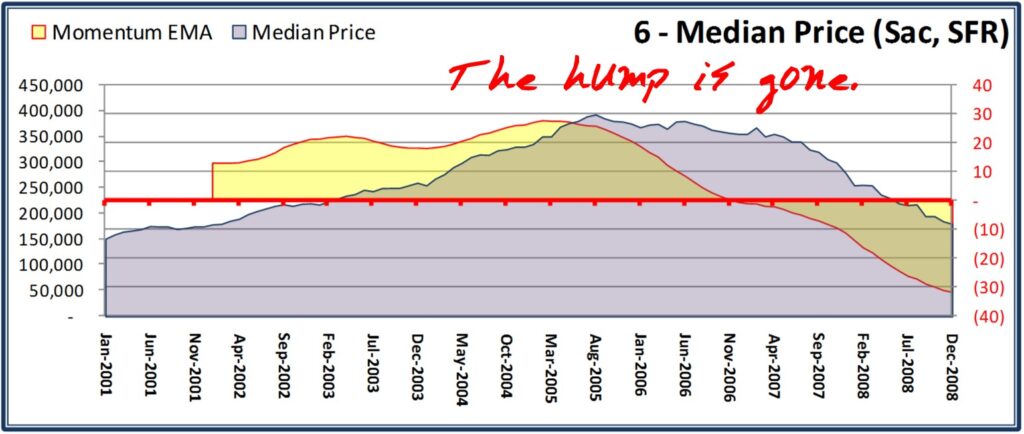

Our region has not been this affordable for over 9 years. And affordability is key. This is a two-edged sword though. As prices decline, so does buyer confidence. More people stay on the sidelines. It’s the demand that we need to spur. Congress has ideas. Some are good ideas and others need to be scrapped. Because the economy goes in cycles like real estate, my opinion is that this is a necessary correction and we will come out MUCH better on the other side as long as we have a memory of the causes. Our current market is full of great opportunities and for the right buyer in the right mindset, it’s a perfect time to buy. Investors are getting product at deep discounts, doing some cosmetic fixes, and finding property managers who get renters. The tax benefits can add to the bottom line (talk to a qualified CPA) which should be taken into account when crunching the numbers. Cash flow is king right now and my system of locating, previewing, and communicating great homes is not matched in Northern California. In fact, I’ve not found ANYONE with this level of research and analysis. Go to my Investor Portal (www.BuyHomesInSac.com) and learn how you can start.

Part of my research entails zip code trending. I have charted years of price trending for over 45 zip codes in Sacramento, Placer, and El Dorado Counties. When someone says “real estate is local”, “local” can mean “down to the street/neighborhood/zip code”. My trending analysis shows that some zip codes can go nowhere but UP. These zip codes are great targets. Other zip codes still have some decrease left in them. When the news media mention more declines, ask them “which zip codes”. They can’t tell you.

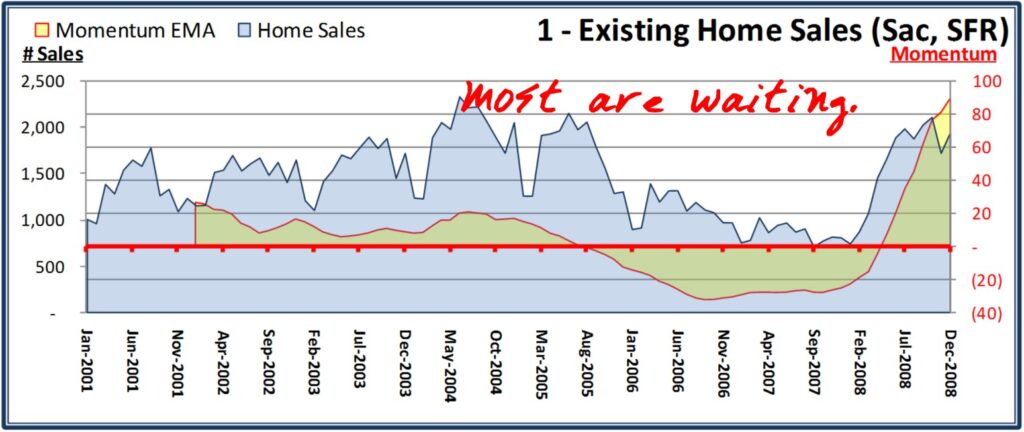

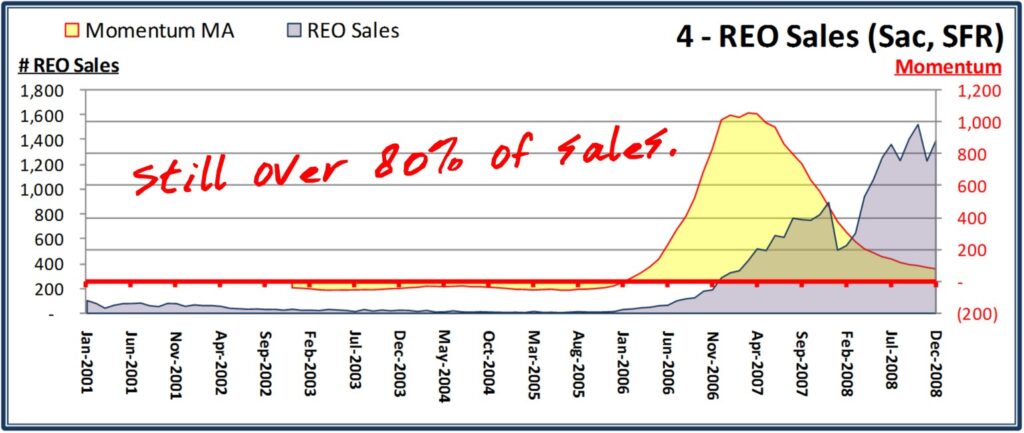

What the indicators cannot show are the pending legislative changes. Bank motivation is going up. Demand is increasing. My analysis is similar to what is used in commodity trading (real estate is a commodity). While most useful to an investor, understanding the market is always helpful. This is a tool to predict the NEXT data point. Explaining history should be done but it’s the NEXT action that makes a difference. Refer to this month’s charts and note where the Momentum indicator crosses it’s zero axis (red axis & typeface) — it has been a predictor of the change in actual volumes.

Let me help you proceed prudently. No investment is risk-free, by definition. My promises to you: 1) Give you an education in real estate. 2) Add value to your life. 3) Be the best Realtor I can be for you and anyone you refer to me. You can see that these are not just goals but, rather, promises. If I’m falling down on any of these, please let me know and give me a chance to correct it. YOU are the reason I chose this career.

These charts depict the momentum of changes in the underlying raw data to help forecast direction. These are not a guarantee of future direction but aid in the prediction of cause/affect in the various market forces. No single indicator tells the whole story. Also charted is the raw data itself.

More commentary

- Existing Home Sales — Momentum fell below zero in Aug ‘05 indicating the drop in Sales in Jan ‘06. Momentum hit bottom Dec ‘07 indicating the Sales spike in Mar ‘08. Momentum is still positive. Recent decrease in inventory makes for a decrease in sales.

- Permits — Momentum exceeded zero first in Apr ‘02, spiked with the last big builder push, and has stayed at or below zero since Sep ‘04. Builder’s are giving great incentives on empty inventory and aren’t starting new homes.

- NODs — Momentum exceeded zero in Nov ‘05 indicating the NOD increase in early ‘06. Momentum peaked in Aug ‘07. Banks have released the pent up supply with 90% of these going to foreclosure in the coming months.

- REO Sales — Momentum exceeded zero in Jan ‘06 indicating Apr and May ‘06 spikes. Momentum is barely positive and is still parallel to total sales.

- Rate — Momentum went below zero in Aug ‘07 indicating the Oct ‘07 drop. Rates are at historic lows.

- Median Price — This is county-wide. Momentum peaked in Feb ‘05 indicating the Price peak in Aug ‘05. Momentum fell under zero in Nov ‘06 and Prices really started to fall in March ‘07. Momentum is still negative and is back to pre-hype levels.

What is YOUR NEXT ACTION?

- If you are an experienced or 1st time investor, let me educate and guide you.

- If you are a Buyer — You have choice, low cost of funds, lower competition, and motivated sellers.

- ACTION PLAN: Hire me. Decide on strategy. Bank your cash. Determine your buying power. Understand your requirements so I can build you a custom website. Eliminate homes you won’t consider. Banks and builders are competing — new homes come with incentives especially if you bring me with you. Tour the homes you desire. Make your best offer. Go into contract. Settle all disclosures, inspections, and conditions.

Sign, buy, and move! - If you are a Seller — If you are in dire straits, call me immediately. This is the only reason you should be selling now (unless you have to move).

- ACTION PLAN: Hire me. Decide on strategy. Stage your home. Keep home clean and available. Market, market, market your home. Consider ALL offers. Go into contract. Settle all disclosures, inspections, and conditions.

Sign, sell, and move!)

Whether you are buying or selling, my service commitment to YOU is unequaled. If you know someone who is looking for a great Realtor and would appreciate the same service I would give you, please give me their name and number and I’ll follow up. You know you can trust me.