Sacramento Metro Real Estate Market Update - 2009 January

No B.S. Commentary

“Truth”: What is it? In politics, it is a useless word. As a small business owner, we don’t get enough of it. As a favored client or friend (or both), I want to give YOU as much truth as I can. The best way I can do that is to show you the data, show you how that data is trending, give you my interpretation of each, and let you come to your own decision. Unlike the newspapers that don’t report meaningful data and unlike Congress who refuses to admit the truth, I spend hours each week ensuring my No BS Commentary is improved and unadulterated.

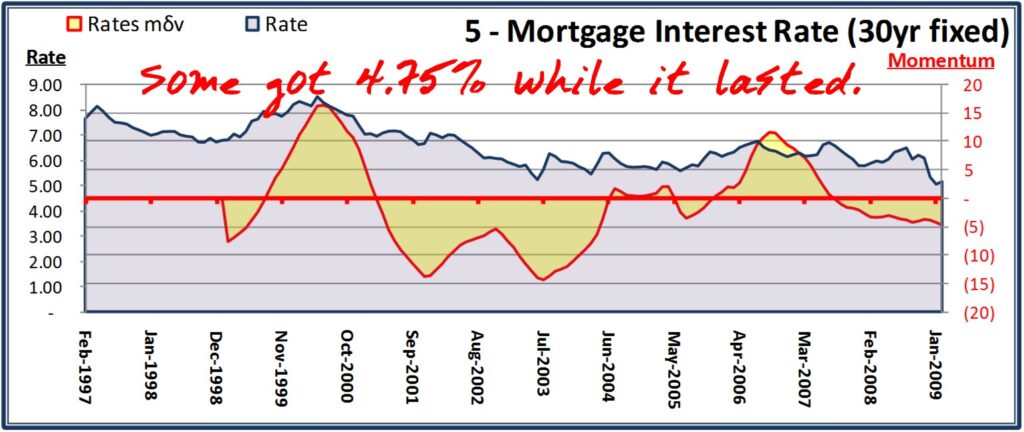

This local real estate market is improving By improving, I mean more people are able to buy and most of them are jumping at the opportunity. The radio and newspapers tell us about national statistics and trends. There are very few places in this country where homes are this affordable AND that offer the climate, standard of living, and future potential. Mortgages and rents are at a point of equality. This means that if you are renting and have no other reason than affordability, now is the time to get off the fence. Build your own equity rather than your landlord’s. If you know someone who is renting, has some savings, and has a stable income, do them a favor and send them my contact information. We both will thank you.

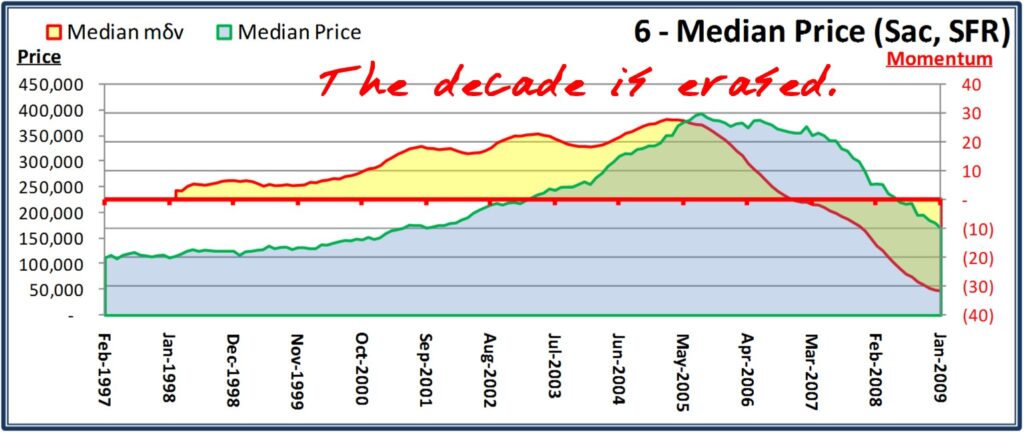

Do we still have some declines ahead of us? Probably. Is this true across all zip codes and areas? Maybe. I can’t give you that kind of truth until after it happens. What I can do is show you the median sales price data for the 50+ zip codes that I track each month. This is a good indication of relative market value. The trending helps us understand the momentum behind the changes in that data. Pick a zip code in this area and I am probably tracking it. And they are all plotted against the Sacramento, El Dorado, or Placer County median prices. This is a good indication of the value in a zip code as compared to the County and surrounding areas. This is no small feat and I’ve recently charted this data back to 1997. It becomes VERY obvious that “the hump is gone”.

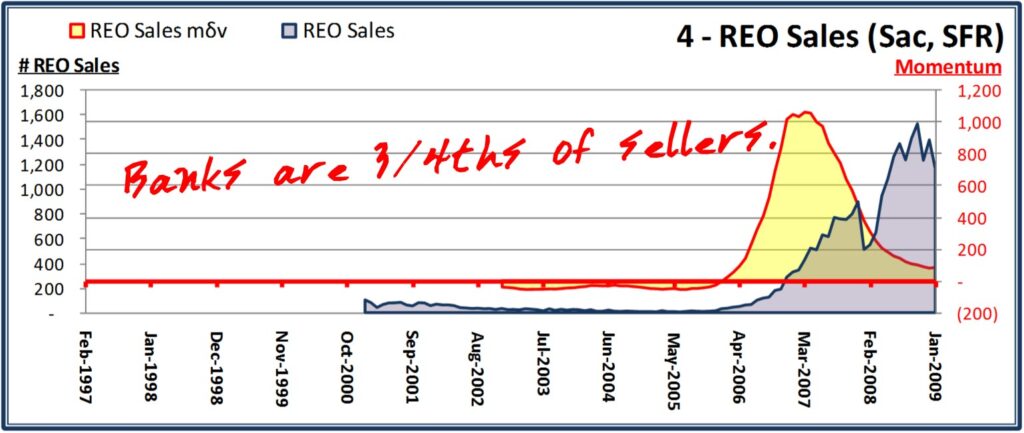

Are banks out of money? No. Do banks like to own real estate? No. This is why prices, in my opinion, have been OVER-depressed. Banks are an unemotional lot and they are reducing prices beyond the market values in order to spur multiple offers that result in a higher sales price. Ask some of my buyers who have been out-bid on various properties. Is this ethical? Probably not. Are banks big on ethics? I’ll let you answer that one.

Inventory has steadily decreased over the last 18 months while sales have spiked. Since June 2008, we have consistently sold over 20% of all inventory each month. In December we sold 30% and last month it was 26%. I wouldn’t call that dismal but that’s exactly what the media calls it. Homes are listed for an average of 3.8 months now as compared to 10 months in July 2007. Some people have not heard all the bad news. Or, as my buyers have told me, they know that the news is not all true. Some of them want the bad news to continue out of the mouths of the press so THEY can scoop up the good product. And I have many investors doing just that.

Sacramento’s median price ($169,000) is now the same as it was in May 2001. In that same month, interest rates were 7.15%. Do you remember those days? Guess what! There were 78 bank-owned homes sold in May 2001. The press acts as if REOs are a new phenomenon brought on by greedy bankers. In all truth, there are many more REOs today but (again, my opinion) that’s more a result of Socialist policy than of greedy banks.

Don’t sit on the fence and watch this opportunity pass you by. Our current market is full of great opportunities and for the right buyer in the right mindset, it’s a perfect time to buy. Cash flow is king right now and my system of locating, previewing, and communicating great homes is not matched in Northern California. In fact, I’ve not found ANYONE with this level of research and analysis. Go to my Investor Portal (www.BuyHomesInSac.com) and learn how you can start.

.

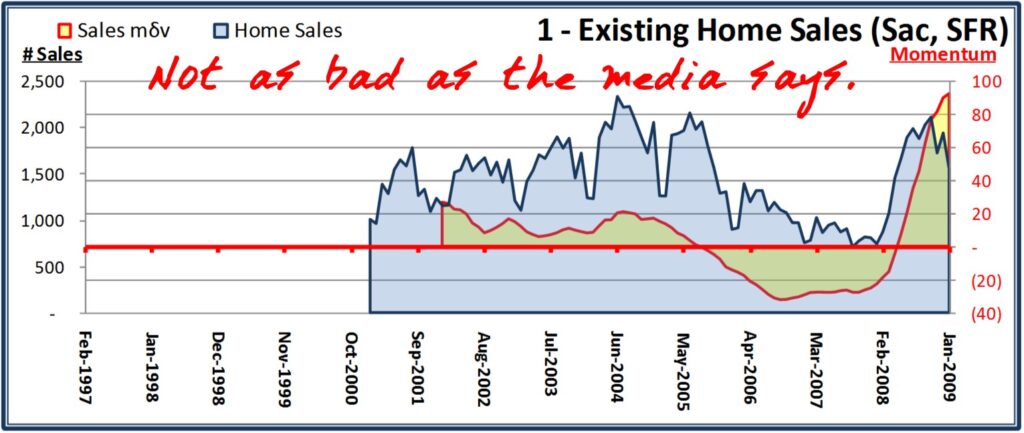

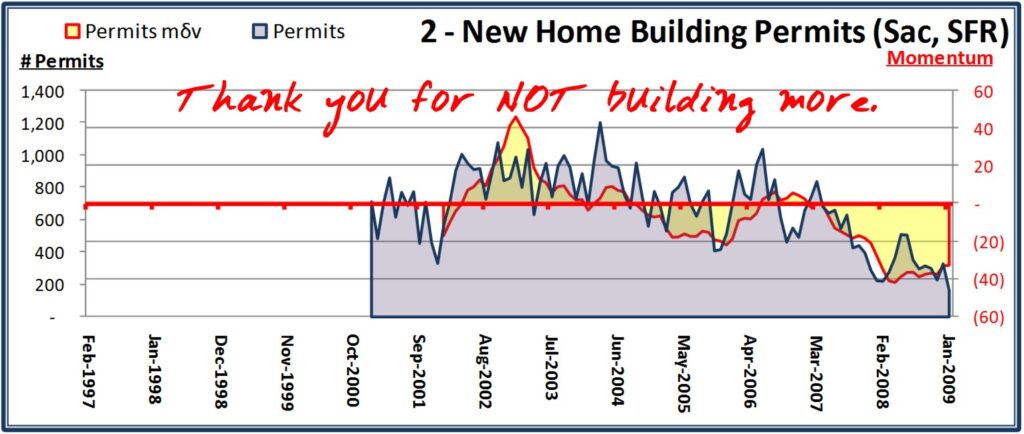

These charts depict the momentum of changes in the underlying raw data to help forecast direction. These are not a guarantee of future direction but aid in the prediction of cause/affect in the various market forces. No single indicator tells the whole story. Also charted is the raw data itself.

More commentary

Refer to this month’s charts and note where the Momentum indicator crosses it’s zero axis (red axis & typeface) — it has been a predictor of the change in actual volumes.

- Existing Home Sales — Momentum fell below zero in Aug ‘05 indicating the drop in Sales in Jan ‘06. Momentum hit bottom Dec ‘07 indicating the Sales spike in Mar ‘08. Momentum is still positive. Inventory is still declining as are sales. But we are still selling over $260M in real estate each month.

- Permits — Momentum exceeded zero first in Apr ‘02, spiked with the last big builder push, and has stayed at or below zero since Sep ‘04. Builder’s have all but ceased new building (thankfully).

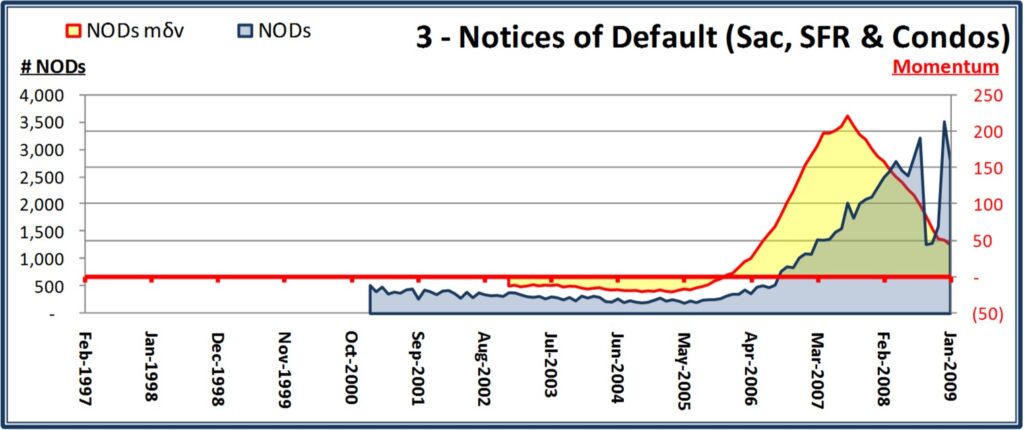

- NODs — Momentum exceeded zero in Nov ‘05 indicating the NOD increase in early ‘06. Momentum peaked in Aug ‘07. January was a bit slower than December but still a healthy volume of defaults filed.

- REO Sales — Momentum exceeded zero in Jan ‘06 indicating Apr and May ‘06 spikes. Momentum is barely positive but REOs will be a large part of the market for some time.

- Rate — Momentum went below zero in Aug ‘07 indicating the Oct ‘07 drop. At the rate Congress is printing money, rates can’t stay this low. Each uptick affects affordability.

- Median Price — This is county-wide. Momentum peaked in Feb ‘05 indicating the Price peak in Aug ‘05. Momentum fell under zero in Nov ‘06 and Prices really started to fall in March ‘07. Momentum is still negative and is back to May 2001 levels. The decade “hump” is gone.

What is YOUR NEXT ACTION?

- If you are an experienced or 1st time investor, let me educate and guide you.

- If you are a Buyer — You have choice, low cost of funds, lower competition, and motivated sellers.

- ACTION PLAN: Hire me. Decide on strategy. Bank your cash. Determine your buying power. Understand your requirements so I can build you a custom website. Eliminate homes you won’t consider. Banks and builders are competing — new homes come with incentives especially if you bring me with you. Tour the homes you desire. Make your best offer. Go into contract. Settle all disclosures, inspections, and conditions.

Sign, buy, and move! - If you are a Seller — If you are in dire straits, call me immediately. This is the only reason you should be selling now (unless you have to move).

- ACTION PLAN: Hire me. Decide on strategy. Stage your home. Keep home clean and available. Market, market, market your home. Consider ALL offers. Go into contract. Settle all disclosures, inspections, and conditions.

Sign, sell, and move!)

Whether you are buying or selling, my service commitment to YOU is unequaled. If you know someone who is looking for a great Realtor and would appreciate the same service I would give you, please give me their name and number and I’ll follow up. You know you can trust me.